Anatoly Kochetkov

Cand. of Sc.(Geol.&Min.)

In June 2001, the President of Russia signed a decree on the procedure of import and export of precious metals & stones, thus having facilitated foreign trade operations with them. Along with the liberalization of the external market of precious metals, this measure assisted in the build-up of output tonnage by Russian gold producers. However, a lot of other problems interfering with the usage of enormous gold reserves in the interior of Russia are still available.

HEAVY BURDEN OF FREEDOM

The gold mining industry of the former USSR was progressing according to particular rules. In the centralized planned economy an efficiency of plants‘ operation was dictated, first of all, by product tonnage and, in a lesser degree, by production profitability. The system permitted an existence of evidently lossmaking placers/mines and at the same time supported stable high output rates. A united well-arranged geological service carried out a systematic study of the territory, widening the mineral base of mine undertakings at the cost of the state budget.

The gold mining industry of the former USSR was progressing according to particular rules. In the centralized planned economy an efficiency of plants‘ operation was dictated, first of all, by product tonnage and, in a lesser degree, by production profitability. The system permitted an existence of evidently lossmaking placers/mines and at the same time supported stable high output rates. A united well-arranged geological service carried out a systematic study of the territory, widening the mineral base of mine undertakings at the cost of the state budget.

Annually, the USSR used to mine about 300 t of gold (302 t in 1990, ranking the second below South Africa) and supplied 100 to 400 t of this metal to the world market. In the 70s, the Russian gold sales were large, amounting to 10 % of the world sales. The wheat corn import was paid for in this way, and in the last years before the USSR‘s collapse the gold & exchange reserves were directed to the support of the dying economy. It resulted in the reduction of the national gold reserves from 2,050 t (1953) to 485 t (1991), i.e., to 2.5 g per capita (32 g in the USA)

In 1992 the gold reserve of the sovereign Russia was only 290 t.

|

Full-scale gold production process: oxidized ore preparator of Olimpiadninsky Mine & Concentrator in Siberia. |

This figure became the reference point for the new history of Russian gold. Its development was dramatic. Just like in other economic sectors, mass privatization was carried out in the gold mining industry. A great many economic units emerged, numbering 566 in 1999, instead of former big well-equipped complexes. Almost a half of the output tonnage is produced by 16 joint-stock companies with an annual production of over 1 t while 400 diggers‘ teams produce only 11 % of the precious metal. Small and medium-size undertakings are deprived of equipment and funds required for mastering large projects, first of all, gold-ore fields. First holding companies appeared in this sector quite recently.

A scope of prospecting by the geological service drastically decreased because of insufficient financing. Ultimately, the explored build-up of gold reserves even failed to offset the lowered output. For a decade, not a single big field has been discovered in the Russian territory. At present the projects explored in the 70s and 80s are being worked. In the USSR gold-ore prospecting was mostly focused on the Central Asian republics, independent states now. The biggest gold-ore deposits, together with the most advanced gold mining undertakings, remained there. Meanwhile a lot of promising fields in Western Siberia were left untouched. Only in 2000-2001 the works at new primary gold deposits started.

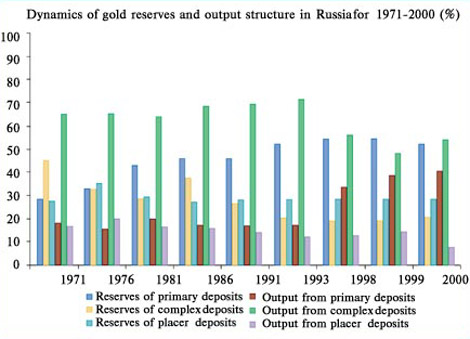

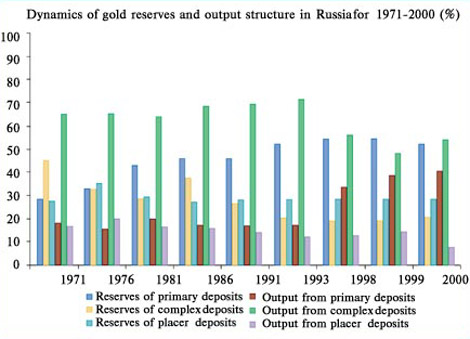

Russia inherited an obsolete structure of gold mining from the USSR. Mostly, the placers which did not require up-to-date technologies were in operation. The share of primary gold was no more than 17-18 % in the total output (with 38 % in 2000). But it was not in line with the structure of reserves. In 1991 primary deposits account for 46 % of Russian gold reserves, with 54 % in 1999. The share of placers in 1999 was only 18 % (see the figure).

In 1991-1998 a system of state purchases of precious metals existed. It was poorly provided for with budget funds. The federal bodies delayed the payment for the gold incomings, in turn not permitting a timely and good preparation for the next season of gold mining. The state was late in advance payment made with a very high interest rate.

All the above-mentioned problems caused a decline in the output of this precious metal that lasted seven years. For comparison: in 1991 Russia produced 143.7 t of gold (6.8 % of world output), in 1998, 114 t (4.5 %). A favorable event for gold producers turned out to be the radical fall of the ruble exchange rate in August, 1998. It brought about a rise of earnings from gold sales and improved the financial position of the undertakings. But even the increase in the gold production in 1999 (125.9 t) and 2000 (142.6 t) allowed only the seventh position to be occupied by Russia among the world producers. Meanwhile, in terms of total mineral gold reserves, Russia is ranked world-third below South Africa (36,000 t) and the USA (9,280 t)

BANK CREDIT IS MORE RELIABLE THAN BUDGET SUBSIDIES

Since 1999, positive trends in the financing of gold miners have been observed, and it strengthened the gold market. In 2001 Russia produced a record gold output for the entire post-Soviet period, more than 150 t.

The renouncement of gold monopoly by the state involved a drastic rise of gold purchase by commercial banks. In 2000 the total quantity of gold mined that year was sold. Commercial banks were granted with a right to export gold and they made use of this privilege. Owing to the policy of accumulation of gold reserves that is pursued in Russia, the Central Bank of Russia (CBR) is very active in buying gold at LME prices on the date of deal minus 5.5 % (minus 2 % before October, 1999). Due to competition with CBR, the commercial banks reduced the margin to 1.3-1.8 % in 1998.

As estimated by World Gold Council as on March, 2001, the Russian treasury gold reserves were 388.7 t. At present, Russia can sell up to 75 % of the annual gold output in the world market without any damage to its gold & exchange reserves.

According to the data of the Union of Gold Producers of Russia, in 2001 commercial banks granted credits to gold mining undertakings for an output of about 144 t of gold. And they go beyond it. Several commercial banks (Zenit, Nomos, Avangard, etc.) swing from credits to direct investments in geological prospecting and mining of gold. In this connection there appeared considerations that for the time being there is no need of foreign investments in the gold-mining sector; here an example of Polyus, a Russian company that mastered the large Olimpiadinsky deposit, is cited. Own funds are used by Severny (North) Gold JSC (with participation of Geometall-Plyus JSC) at the Dvoinoye deposit in Chukotka, by Seligdar at the Samolazovsky deposit in South Yakutia, by Amur at the Ryabinovoye and Tas-Yuryakh deposits in the Khabarovsk Krai.

Along with it, the practice of mastering of the Kubak deposit by a joint Russian-Canadian venture shows that foreign investments can and must be attracted. The amendments to the Russian law "On Mines-and-Carriers" which were adopted in 2000 were positively responded by investors. Now a company that receives a license for geological survey of an area of possible mineral manifestation has a right for its prospecting and mining without tenders to be announced. Great hopes are pinned by producers and investors on the adoption of a law on division of products. Unfortunately, up to now decisions on mechanisms of division of products as applied to individual deposits are taken in an extremely sophisticated way, and the law proper has not yet received enough support despite long debates in the Russian parliament.

Big foreign companies do not come to Russia although only they have enough power to master large gold-ore fields. The activities of small and rather frequently doubtful companies discredit foreign investors in Russia. This happened with Gold Star Technology, an Australian partner of the joint venture on the Sukhoy Log project. Only nine companies out of 18 Canadian gold miners who tried to take part in the mining of precious metals remain in Russia at present. A drop of world gold prices is partially responsible for it. But the factors which deteriorate the investment climate: imposition of new taxes, among them, an export duty; injury to foreign companies‘ rights in legal proceedings; imperfect Russian laws; also had their effect on it. For instance, the 5-% duty imposed on gold export in 1999 substantially reduced an export potential of this sector. In the opinion of the gold producers, a tax load on miners is too high in Russia. This view is confirmed by the data of the Ministry of Economy of Russia: in 1999 taxes and other budget payments accounted for 40 to 42 % of the costs of mined precious metals. Such taxes are more effective than fluctuations in world prices in decelerating the development of the sector.

Thus, the capabilities of the Russian gold mining industry are far from being exhausted. Its rapid progress could be helped by structural changes aimed at overcoming the fragmentation of the sector and forming powerful financial and industrial groups. These groups must enclose all links of the precious metals market, from gold mining till making of jewelry and industrial products.

|

The Kubak gold-bearing field is being developed by a joint Russian-Canadian venture |

LATENT POTENTIAL

Under these complicated conditions the gold market is being established in the country that for a century and a half has been one of the biggest gold producers. In 1991 the collapse of this powerful gold-producing nation occurred, and several independent producers appeared instead of one: Uzbekistan, Kazakhstan, Kyrgyzia, Russia. Having entered the community of gold exporters as a sovereign state, Russia (against the USSR) drastically decreased its influence on the development of the global situation. Since 1992, the share of the Russian gold in the world sales varies from 0.3 to 1 %. For comparison, the share of Canada was 3.3-4.1 %, the USA, 6.34-9.1 %.

Russia has already left the upper positions of world producers, being in the same group as Ghana, Papua-New Guinea, Brazil, and such re-exporters like Japan, France, Singapore. The first places among the gold-sellers are occupied by the main re-exporters: Switzerland that sold about 1,800 t of gold in 1998, and the UK (629.4 t) as well as the main producers: the USA (510.7 t), Australia (505.1 t) and South Africa (464 t). Primary gold accounts for about a half of world export. Thus, almost all gold mined by South Africa (464 t in 1998), Australia (505.1 t) and Canada (230.9 t) goes for sales. According to our estimation, in the last decade Russian export varied from 10 to 45 % of annual output.

Russia is much below the industrialized and some developing countries in home demand of gold. Gold is sold, for the most part, as jewelry. Its home prices exceed the world ones by 1.5-2 times with a constant decrease of sales tonnage (12 t in 1997). In 1998, owing to the financial crisis, sales of jewelry grew to 18 t, and in 1999 again fell to 9 t with a potential demand ceiling of 50 t minimum. Meanwhile the jewelry making capacities are 30-40 % utilized in Russia.

None the less, this review must be completed with an optimistic conclusion. Despite all difficulties which the world market of precious metals undergo, Russia retains a considerable investment potential in raw materials sectors, including output of gold. It means that the Russian gold producing industry looks forward to a new rise in the foreseeable future.

|

back

back

The gold mining industry of the former USSR was progressing according to particular rules. In the centralized planned economy an efficiency of plants‘ operation was dictated, first of all, by product tonnage and, in a lesser degree, by production profitability. The system permitted an existence of evidently lossmaking placers/mines and at the same time supported stable high output rates. A united well-arranged geological service carried out a systematic study of the territory, widening the mineral base of mine undertakings at the cost of the state budget.

The gold mining industry of the former USSR was progressing according to particular rules. In the centralized planned economy an efficiency of plants‘ operation was dictated, first of all, by product tonnage and, in a lesser degree, by production profitability. The system permitted an existence of evidently lossmaking placers/mines and at the same time supported stable high output rates. A united well-arranged geological service carried out a systematic study of the territory, widening the mineral base of mine undertakings at the cost of the state budget.