Vladimir Denisov

For investors in Russian businesses, increased political and economic stability is a welcome sign. Some prominent firms in Russia considering expansion are looking at stock markets abroad to raise capital. One question many international investors have about SUAL group of companies (named below SUAL), Russia’s second-largest aluminum producer, is whether it is ready to go public on an international market. SUAL’s top managers have been asking themselves this question as it seeks to issue shares abroad and develop strategic international partners in the coming months.

Western investors have proven receptive to Russian companies in the past year. Recent IPOs by Russian companies in the U.S. and Europe have been fairly successful, to the surprise of many analysts. U.S. investors and journalists were impressed by the frankness in Russian food and juice giant Wimm-Bill-Dann’s pre-IPO filings, for example, in light of the string of corporate scandals in the U.S. in the past years. It seems that international investors’ post-1998 concerns about Russia’s stability in world markets have taken a back seat in favour of those about transparency and corporate responsibility. SUAL group of companies is placing its own transparency and accountability among its top priorities as it tests the waters in European and U.S. financial markets.

Victor Vekselberg, Victor Vekselberg,

SUAL Holding President

"Our company is going to be public in the nearest future. Usually the potential investors expect the functions of the owner and the manager to be separated. This is one of the reasons why it is time now to leave the post of SUAL Holding President.

Furthermore, the main structure has already been formed and it works, including the solid system of management. Thus the presence of one of the main shareholders in day-to-day decision making is not crucial anymore."

|

MARKET NICHE

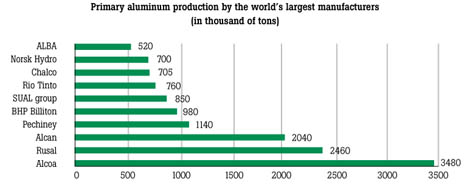

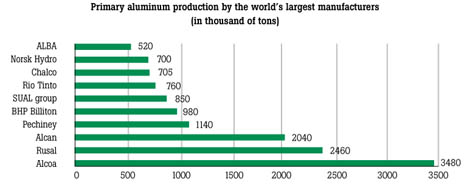

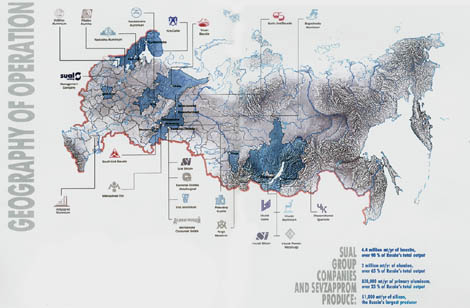

SUAL Holding is the management company for the 19 mines, smelters and plants and 58,000 employees that make up the SUAL group of companies. The combined company is now the second largest aluminum company in Russia and among the top ten aluminum producers in the world. SUAL group of companies has access to the vast bauxite reserves and energy resources required in aluminum production. It is also one of the few aluminum companies in the world that supplies all of its own raw materials to its alumina and primary aluminum smelters.

In 2001, over 60 percent of the group’s metal exports were carried out under long-term contracts. The company’s major partners include Alcoa, Alcan, Pechiney, Norsk Hydro, Mitsui, Toyota, Mitsubishi, Honda and many others.

Yevgeny Olkhovik, Yevgeny Olkhovik,

Chief Operational Officer

"At the moment decision-making and problem solving for the current questions are delegated to the top managers of the enterprises and coordinated by SUAL Holding, as the main brain center for the whole company. We give management on the operational level a free hand in such matters as rules, dates and terms of contracts with providers. This management model has made a significantly positive impact on the performance of the group as a whole. Improved scheme of interaction between the business units boosted the group’s effectiveness and helped achieve the set objectives, as you can see from the numbers."

|

NEXT STAGE

At the meeting of Moscow’s American Chamber of Commerce in Summer 2002, SUAL Holding President Victor Vekselberg said that he expects to take the company public by the middle of 2004. To prepare for this, SUAL’s accountants have been busy converting their statements from Russian to International Accounting Standards (IAS). Bringing SUAL under IAS and making its audited statements public will certainly contribute to attracting international attention to the company. Investment analysts will find in the numbers a company with strong profits, sound management, and a long-term growth potential.

"Unfortunately, due to reasons unrelated to performance, the values of some major Russian industrial companies are extremely, and often unfairly, undervalued by Western analysts. For instance, our company, SUAL group of companies has a range of significant advantages that place it on par with major world players. And recently we have done a great deal to make our company more transparent and enhancing shareholder value for both Russian and international investors," said Vekselberg.

For the same reasons, it has recently been reported that Vekselberg plans to leave his post of the president of SUAL Holding, management company and that he would likely take up the position of chairman at SUAL Holding.

Vladimir Skornyakov, Vladimir Skornyakov,

First Vice President

"One of our main priorities at the moment is to achieve high effectiveness of our investments as we direct more than half of our profits toward business development: the moder-

nization of existing production facilities and the construction of new ones. Such a high percentage of invested funds clearly illustrates our long term intention to following world standards of business development."

|

| Irkutsk Aluminum. Semi-finished products storage. Aluminum rod |

PRINCIPLES OF CORPORATE GOVERNANCE

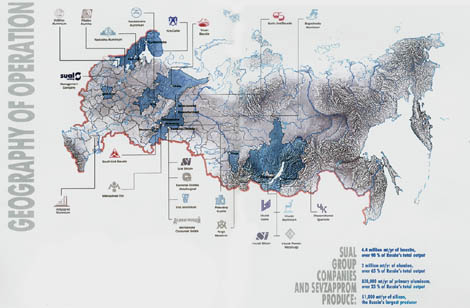

SUAL Holding ensures the seamless interaction between each of the SUAL group of companies to produce high-quality products. Its 19 companies are based in regions ranging from Karelia in the North-West to the Urals region to Siberia. SUAL group of companies takes advantage of proven corporate management practices and applies them throughout the group. It coordinates activity between the enterprises and also pursues a unified investment strategy intended to exploit each company’s competitive advantages.

SUAL’s day-to-day management concept involves a close interaction between the management company and its constituent divisions. Central management identifies guidelines and key financial and economic parameters for budget planning on the individual plants’ level.

The dynamics of SUAL’s business development exceed the industry’s average, both inside and outside Russia. While the world’s 2001 primary aluminum output was down 1.8 % for the year and Russian output was up 1.7 %, the SUAL group of companies increased primary aluminum production by 3.5 %.

"Management, both at SUAL Holding and at our enterprises, is happy with the chosen model of corporate governance and we will continue to improve our business standards and positively contribute to the corporate culture on the Russian market," added SUAL Holding Chief Operational Officer Yevgeny Olkhovik.

Alexey Goncharov, Alexey Goncharov,

Corporate Affairs Director

"In addition to being a major taxpayer, with our contribution to the national budget at about 3 billion rubles ($100 million) in 2001, we bear a huge social responsibility as the economic and social situation in the company and neighbouring cities are closely linked. With this in mind, we take part in sponsoring local institutions and charitable activities, apart from carrying out our corporate social policies through health services, sports activities and cultural events for our employees and their families."

|

KOMI PROJECT HIGHLIGHTS:

NEW JOBS:

approximately 2,000 people

TOTAL TAX CONTRIBUTION:

over the lifetime of the project $ 1.8 billion

BUSINESS STRUCTURE BUSINESS STRUCTURE

SUAL’s investment policies are applied to its five main business lines: mining group, primary metal group, silicon, cable and semi-fabricated products. The policies are aimed at making production more efficient and effective, increasing technological integration and making SUAL’s products more competitive. SUAL group of companies developed a plan in 2001 to achieve its goals through 2010 which is now being implemented.

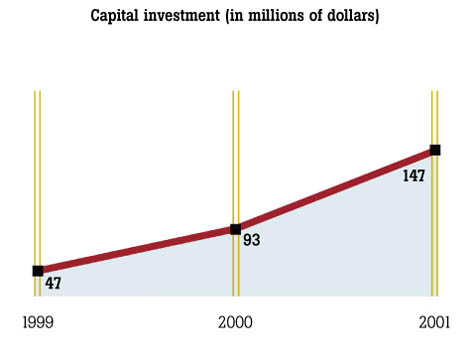

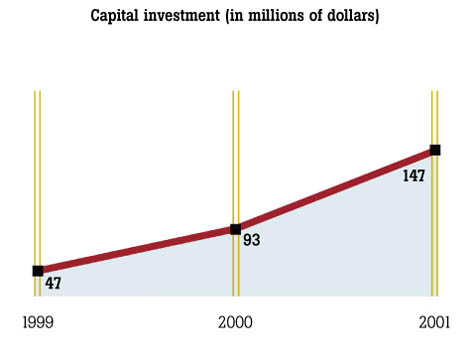

The company allocated 52 % of its 2001-2002 investment funds to bauxite development, 33 % to alumina and aluminum production and 15 % to value-added product manufacturing.

SUAL HOLDING HIGHLIGHTS 2001:

REVENUES

$ 1.3 billion

CAPITAL EXPENDITURE

$ 147 million

Vladimir Kremer, Vladimir Kremer,

Member of the Board

"Despite another cyclical worsening of the foreign market, SUAL group of companies managed to increase aluminum sales to the world’s largest consumer markets. These results represent the efficiency of improvements gained from the company which are based on its growing internal potential. One of our main goals at the moment is to maintain our achievements, intensify the manufacturing of value-added products and further development of long term relationships with direct customers."

|

ENVIRONMENTAL COMMITMENT

Part of the strategic plan takes into account environmental effects. "A plant that is made more efficient not only boosts production, but helps the environment as well. In this sense, our business’ goals and the environment’s do not conflict," said SUAL Holding First Vice President Vladimir Skornyakov. "Environmental conservation is key to the development of any business based on natural resources," he added. SUAL group of companies conforms with all Russian laws pertaining to the environment. It has also invested $15 million in environmental protection technologies at its enterprises in the past two years. At the same time production increased by 13 %, emissions by SUAL enterprises fell by 33 %.

COMMUNITY INTERACTION COMMUNITY INTERACTION

SUAL group of companies takes its social responsibilities very seriously. Since SUAL’s enterprises form the backbones of the nearby communities, it partners with authorities to promote local development.

The effectiveness of SUAL social policy efforts is illustrated by the results of the second national contest "Russian Organisations with a High Social Effectiveness", held in 2001, where two SUAL’s enterprises, Bogoslovsky Aluminum and North-Ural Bauxite, emerged as the winners of the most prestigious nominations.

COMPETITIVE ADVANTAGES COMPETITIVE ADVANTAGES

SUAL group of companies will be blessed with an abundance of raw materials for the foreseeable future. The company now produces 90 % of Russia’s bauxite. While its South-Ural bauxite mine is scheduled to close by the end of 2002, most of SUAL’s annual 4.4 million tons bauxite production now comes from the underground North-Ural bauxite mine with 3.5 million tons production per year. North-Ural Bauxite should continue to supply SUAL with bauxite for at least the next

80 years. Furthermore, its giant Timan bauxite mine in Russia’s Komi Republic is the largest of its kind in Russia. Its geological parameters are really unique with proven reserves of 250 million tons, it currently provides 780,000 ton a year via strip mining but that is scheduled to increase to 2.5 million tons by 2004.

NEW CHALLENGE IN KOMI REPUBLIC

As mining production expands, however, SUAL group of companies will need to invest in and build more alumina refineries and aluminum smelters order to produce more semi-finished products and consumer goods afterwards. There is a plan to build a world-class alumina/aluminum production complex near the site of the Timan bauxite mine. Russia’s first private railway has already been constructed linking the site to Russia’s federal rail network. SUAL group of companies has already invested $100 million in this project and expects to invest further in the infrastructure development in the region. The expected investment needed to build the future Komi alumina/aluminum complex is currently estimated at U.S. $2.2 billion.

| Ural Aluminum. New electrolysis shop. |

FUTURE BENEFITS

SUAL group of companies’ senior management sees the future of the Komi Project as the key to SUAL’s continued prominence on the world aluminum market. SUAL group of companies is standing as a well-balanced company that supplies its own raw materials sets it apart in the aluminum industry today. The increase in production at the Timan Bauxite with the corresponding increases in metal, in semi-finished and in fabricated goods output will ensure SUAL’s growth on the international stage.

SUAL group of companies is now seeking Western strategic partners to join in the development of the future complex in Komi. Some potential partners might be wary of making such a large investment with the current state of world markets. However, low capita expenditure and operation costs make the investment lucrative. Furthermore, Russian market, with a relatively low metal per capital consumption, has the potential for impressive growth that is fairly independent of the world markets. SUAL’s future sales revenues are guaranteed through long-term contracts with existing Russian and international partners.

William Shor, William Shor,

Vice President, New Project Group

"Our challenge in Komi is to build a world-class alumina / aluminum complex, one of the most ambitious projects ever undertaken in Russia. Its construction represents a unique possibility to combine Russia’s rich natural resources with Western technology and experience. We aim to be the most cost effective manufacturer of alumina and aluminium in the world, and Hatch pre-feasibility study results confirm the viability of our goals. It promises to be a hugely cash generative project, combining the latest global technology and management expertise and at the same time capitalizing on the traditional Russian advantages of competitive labour costs, abundant natural resources and low energy costs. We see this as not only benefiting SUAL, but also the Komi Republic by generating jobs and investment and then sending positive ripple effects throughout the Russian economy. Thus we see this as not only a sound financial investment but a social and economic one as well."

|

Investors will have to wait for SUAL’s planned IPO in 2004. Of course, under today’s world market conditions, now may not be the most optimal time to raise capital on Western markets. When the time comes, however, SUAL group of companies’ debut on an international stock market will be one of the most anticipated offerings from a mining- and metal- producing company in many years.

|

back

back

Victor Vekselberg,

Victor Vekselberg, Yevgeny Olkhovik,

Yevgeny Olkhovik, Vladimir Skornyakov,

Vladimir Skornyakov,

Alexey Goncharov,

Alexey Goncharov,

BUSINESS STRUCTURE

BUSINESS STRUCTURE

Vladimir Kremer,

Vladimir Kremer,

COMMUNITY INTERACTION

COMMUNITY INTERACTION COMPETITIVE ADVANTAGES

COMPETITIVE ADVANTAGES

William Shor,

William Shor,