Vladimir Katunin

General Director, Central Information & Techno-Economic Research Institute for Iron & Steel Industry (Chermetinformatsia JSC)

or the twelve years elapsed since the start of the Russian economic reforms, the production structure of the steel industry has not undergone substantial changes. For the most part, up to now this sector utilizes facilities set up in the Soviet times. The corresponding production capabilities largely predetermine the today’s behavior of the industry and a lot of problems arising from it

FACILITIES HAVE NOT ALWAYS BEEN REDUNDANT

In the centrally planned economy, the task was to produce steel in order to meet internal consumption as much as possible. Steel shortage was experienced over the whole period of the development of the Soviet economy (the term most often used to denominate an aggregation of industries). Construction, automotive industry and agricultural machine-building, fuel-and-energy complex, shipbuilding and military-industrial complex were not only in need of growing steel output but ever increasingly required new product types, among them, items with special properties. That time favored the development of the steel industry and the build-up of its potential.

|

|

Central Information & Techno-Economic Research Institute for Iron & Steel Industry (Chermetinformatsia JSC).

Set up on April 19, 1943 by the resolution of the State Committee of Defense of the USSR.

Leading information center: it accumulates, systemizes, generalizes and distributes information and analytical documents on status and development trends of Russian and world steel industry, newest scientific and engineering achievements and operating practice of enterprises. It has at its disposal one of the biggest scientific and technical libraries in metallurgy, numbering over 500,000 storage units - books, journals, reference literature and original publications, starting from the 18th century. It issues journals and selections covering almost any important problems of development of Russian and world iron and steel industry.

The institute keeps continuous relations with virtually all enterprises and organizations of the Russian steel industry. It cooperates with foreign colleagues. Six research centers work in the institute, thus promoting its participation in the elaboration of the programs for re-equipping different steel plants/works.

|

| |

|

The productive capabilities ensured an annual output of 170m tons of crude steel, 121m tons of rolled products, 22m tons of tubes/pipes for diversified requirements of steel-consuming industries.

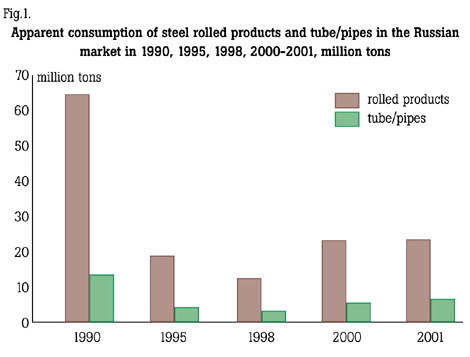

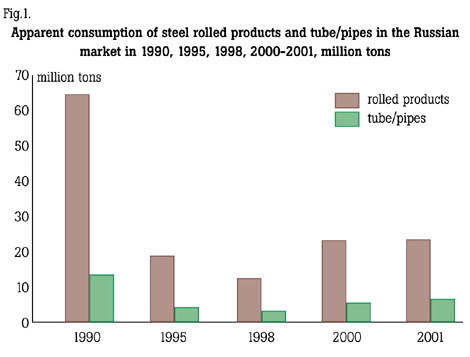

Political changes, property redistribution, elimination of planned principles and unstable economy brought about a five-fold fall of internal consumption of rolled steel, from 64.6m tons in 1990 to 13m tons in 1998. In the same period, the consumption of steel tubes/pipes declined from 14 to 3.6m tons (Fig.1). Due to a dramatic reduction in the internal market, Russia gained the opportunity of exporting steel products, thus employing the available productive potential. Even after the shutdown of a big share of inefficient facilities, the export supplies could reach 35 to 37m tons. But only 24 to 26m tons of Russian steel were claimed by the world market.

In the Soviet Union the steel industry developed with due regard to the traditional disposition of the productive forces. Many product types were profitable to be made in the Ukraine with their further supply to Central Russia, Caucasus and the Volga region. The Ukrainian enterprises used to deliver 13m tons of steel products in total per year to the territory of Russia.

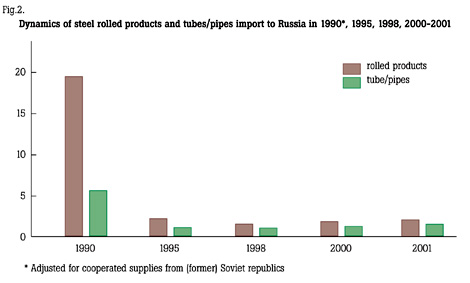

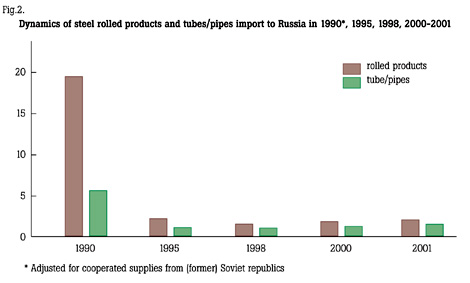

A system of cooperated supplies was widely used. It was aimed at lower investments and the higher utilization rate of existing facilities. For example, in 1990 Russia received 25m tons of semi-products, finished rolled steel and tubes/pipes from other Soviet republics. This figure can be considered a reference value of steel imports to Russia.

At present when the relations between the republics are built on the principles of sovereignty and economic independence, Russia happened to be fully self-provided with the required steel products virtually in any category, with few exceptions, among them, 1420-mm dia. pipes for gas mains.

The import dynamics (Fig.2) shows that the internal market has largely been cleared of import supplies, and in complex with an increase of exports it helped to control the potential economic impact due to a dramatic fall of internal demand for rolled products and tubes/pipes.

|

In future the relations among steel producers in the Russian and CIS markets will depend on cost values in consumption areas and quality of one and the same product. "Fair" competition will also be of great value. For instance, so far there is a dispute concerning the import of Ukrainian steel products. Federal bodies are still uncertain about taking measures on protecting Russian economic interests in the internal market, as is done in most industrialized countries.

|

|

|

Vladimir Katunin

General Director, Central Information & Techno-Economic Research Institute for Iron & Steel Industry. A specialist in engineering and economics, with experience of production and research work in metals industry. Former head of laboratory in the Institute of Economics of Central Research Institute of Iron & Steel Industry, assistant minister of iron & steel industry of the USSR, administration manager of Ministry of Metallurgy of the USSR, deputy director of metallurgy department of Ministry of Industry of Russia.

|

|

| |

|

MODERNIZATION: INCENTIVES AND RESTRAINTS

In the world steel market supply was much higher than demand in 2002. Due to it, steel inventory increased while prices fell. Competition became tougher which aroused a new wave of antidumping investigations and sanctions against steel exporters. Twenty-two countries applied different sanctions against Russia.

Hindrances in the external market forced the steel producers to be more attentive to Russian consumers, the more so as the conditions of operation in the internal market substantially improved. The national currency, ruble, became stronger, the payments system was normalized, the process of privatization of steel plants and works was in fact completed. Certain growth of national economy, including large steel-consuming sectors, is observed.

None the less, like in the world steel industry in general, steel demand in Russia is far behind the available capabilities. Producers of similar items have to face tough price competition. In the internal and external markets steel prices for many product categories became virtually equal, and steel producers fail to offset growing operating costs through price increase.

The Russian steel industry is actively phasing out obsolete facilities. In 1990–2001 the steelmaking capacity was reduced by 20.5m tons (from 93.8 to 73.3m tons) or 21.9 %. The utilization rate of steelmaking plants grew from 63 to 80.5 %. But complex social challenges hindered further elimination of inefficient production operations. For example, it must be taken into account that many steel plants are town-forming. In their towns there is no alternative opportunity to employ inhabitants and find other sources of tax incomings to the local budget. The shutdown of these plants should be accompanied with a state program for setting up new jobs.

Meanwhile, insufficiently rapid modernization of the steel industry can lead to the loss of its competitiveness, especially after Russia enters the WTO. The internal market situation can be aggravated by the build-up of steel import supplies from Ukraine, Moldova and Turkey to the European part of Russia, and from Kazakhstan, China, Japan and Korea to Siberia and the Far East. It may change the economic and social situation. Lower demand for Russian steel will enforce a closure of not only certain steel plants but also related enterprises – coal and iron-ore mines. That is why the task of rapid development of the steel industry becomes a priority in the Russian economy.

Lately, the biggest steel producers – Severstal, the enterprises incorporated into EvrazHolding (Nizhny Tagil Iron & Steel Works and West Siberian Steel Corporation), the Magnitogorsk Iron & Steel Works, the Lipetsk Iron & Steel Works, Mechel, etc. – made out programs for re-equipping. As a rule, they invest in reconstruction and renovation using credits, without any guarantee from the state. Foreign bank creditors demand a careful reasoning which must include detailed market studies, guaranteed sales schemes and business plans. Plants’ owners are also interested in the study of steel market by product category so as to multiply the invested funds.

A difficult-to-predict increase in energy costs and railway tariffs is the factor hindering the modernization of the steel industry. In Russia gas, electric power and transport services go up in price at an outgoing pace. At that it is impossible to determine the economic validity of prices and tariffs owing to low financial transparency of the natural monopolies (including Gazprom, RAO EES Rossiya (United Power Systems JSC) and Ministry of Communications). The federal authorities easily agree to increase in price and tariffs, thus thinking it to be the tool for replenishing the budget, instead of a direct subtraction of the super profit of the monopolies, for instance, in the form of a natural rent, as a majority of other states does. As a result, some part of this profit simply disappears in the black hole of an inefficient economy.

FORECAST PROMISES A STABLE INCREASE IN DEMAND

Chermetinformatsia carried out the studies of trends of important steel market indicators, dynamics and proportions of macroeconomic indices of major steel-consuming industrial sectors, tendencies of general physical and cost indicators of development of the Russian steel industry and national economy, factors and conditions of environment influencing the formation of the iron and steel market.

Below are given some findings of these studies.

In 2001 the internal consumption of finished rolled products was 23m tons, and 5.8m tons of tubes/pipes.

The largest consumers of iron and steel products were machine-builders (11m tons, including 2m tons in the automotive sector), capital development (3.5m tons), fuel-and-energy complex (about 3m tons), railways (1.6m tons).

In the long view, the development pace in steel-consuming sectors will have the largest effect on the internal steel market. According to the forecast of the social and economic development of this country provided favorable external and internal conditions last out, the growth of the gross national product (GNP) in 2005 is predicted at 21.1 % against the level of 2001, the industrial output will increase by 20.7 %.

In the same period, in the fuel-and-energy complex it is intended to increase electric power generation by 5 to 8 %, oil and gas production, 15–22 % (up to 400–424m tons) and 4–7 %, respectively. Oil companies are willing to put on stream new oil production projects in Western and Eastern Siberia, in the north of the European part of Russia, and along the sea shelf which will require an almost two-fold expansion of development drilling operations. In the gas sector, it is envisaged to develop fields in Yamal Peninsula, the Tyumen Region and Yakutia.

Rapid growth, 23 to 26 %, is predicted in machine-building. Higher share of products made by heavy, power, transport, chemical, oil and road machine-building is supposed to be more obvious. The outgoing development of steel-intensive sectors will promote an increase in orders for various types of finished rolled products.

The analysis by Chermetinformatsia of potential investments in the construction industry, including housing, in all Russian regions permits the forecast of a high growth of consumption of finished rolled products, up to 600,000 tons and 1.7m tons in 2005 and 2010, respectively.

The renewal of fixed assets in the leading sectors of the industry and public utilities must become the most important factor of revival in the internal steel market. An increase in military orders must expand internal steel consumption as well.

In 2001 the apparent per capita consumption of finished steel was 154 kg, thrice lower than in the industrial leaders. Such an enormous gap points to very negative processes taking place in the Russian economy, in particular, to the progressing aging of the main production assets whose major share is iron and steel. Meanwhile this low figure of consumption and the necessity of its growth at least to 300 kg in the years ahead show that the potential of the Russian market is essential.

Chermetinformatsia predicts that iron and steel producers can orient to the level of finished steel consumption as follows:

– in 2005 – 49–50m tons, including 25–26m tons in the internal market;

– in 2010 – 55–57m tons, including 30–32m tons in the internal market.

The ratio of long and flat products in the apparent consumption of finished rolled products was 51 and 49 % in 2001. The share of flat products will rise to 50–51 % in 2005.

The percentage of imported finished rolled products in the internal market can lower from 8.5 % in 2001 to 6 % in 2005 and 3.1 % in 2010. But it can be only in case the Government of Russia introduces protective measures against unfair competition from external producers, especially, Ukraine and Kazakhstan, and the plans of re-equipping the Russian steel industry are successfully implemented.

In the opinion of Chermetinformatsia, the above pace of steel demand growth in the internal market is the required minimum for the survival of the Russian economy and maintenance of relative stability of its political and economic situation.

|

back

back