Yevgeny Khokhlov

Contrary to the diffused opinion on the fabulous wealth of the Russian interior, the resources of the base metals in this country are not so abundant and high-grade as to assure an unclouded future for the metals industry. This situation became quite evident when, as a result of the consolidation of property, large integrated companies entered the market. When setting the strategy of their business they discovered the vulnerability of the raw materials component.

hat a substantial reduction of output is possible because of the raw materials shortage was first claimed by Ural Mining and Metallurgical Company (UMMC). Its management made a public statement on ÷an unfavorable scenario÷ according to which in the next eight to ten years this holding will have to decrease the output of copper by 120 – 130 thousand tons, or by about 40 % of the today's level.

The company's calculations are as follows. The total reserves of the Uralian copper are estimated at an impressive value of 19 million tons. But they are distributed by 55 medium and small deposits. The ores are rebellious, for the most part, thus requiring higher processing costs. If to apply western procedures, only 10 % of the reserves can be considered profitable enough to mine. UMMC representatives refer to the conclusions of TACIS experts who studied the situation in the Uralian copper sector in 1998 – 1999. In particular, the world experts estimated the primary raw materials reserves suitable for economically sound processing and correlated them with the actual output. It turned out that the copper reserves would be enough only for six years.

|

|

In Ural, the oldest center of the Russian copper industry, the metallurgical facilities are much larger in capacity than those of the local raw materials base. In this region, there are five copper smelteries and two refined copper plants. Annually they consume at least 300,000 tons of copper in the concentrate with only 200,000 tons of copper mined.

|

| |

|

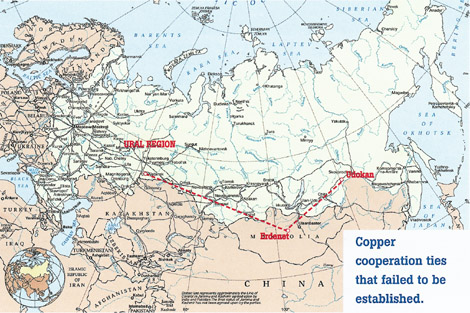

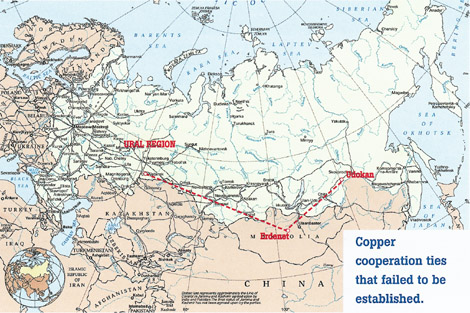

THE LOSS OF ERDENET WAS INEVITABLE

A chronic shortage of raw materials in the Ural region became clear in the beginning of the 1990s. On the one hand, the shortage may be considered an inevitable consequence of the long-time mining of the local raw materials (the commercial mining of copper-bearing minerals started in this region in 1702). On the other hand, the sharpening of the situation was provoked by the changes in the commodities flows after the collapse of the socialist camp. For a long time the Erdenet Works built in Mongolia with the assistance of the USSR had been the biggest partner of the Uralian enterprises. In 1978 – 1991, as this joint venture was expanding, the supplies of the copper concentrates to Russia grew from 130,000 to 385,000 tons per year. But later on the dynamics took a negative twist. In 1991 – 1995 the annual average supplies were no more than 170,000 tons, falling to 50,000 tons in 1996 – 1999. In 2000 only 25,200 tons of concentrate were delivered, and after that the supplies were completely stopped. By the UMMC data, for 1991 – 2000 Erdenet's short supply amounted to 335,000 tons of copper concentrate out of the share belonging to Russia under the intergovernmental agreement of 1991.

| | The Gaisky Mine & Concentrator is still the main supplier of primary raw materials for the copper smelteries of UMMC |

Andrei Kozitsyn, General Director of UMMC, is convinced that ÷Russia has already lost Erdenet÷. The Russian side still legally has some rights for the joint venture in which the rights of Russia and Mongolia were established as 49:51. But the commercial expediency made the Mongolian producers completely reorient to China. That country is much less distant geographically than Ural, and its copper prices, due to a number of reasons, are higher than the world ones. Financially, the works depends on the Chinese traders who credit the Cu concentrate supplies. The Russian experts who audited the operation of Erdenet JV acknowledged the credit terms ÷very unprofitable÷ for the producer. Nevertheless, the credit amount constantly grows: US$48.6M in 1999, and US$63M in 2000.

The outlook for the works' development is driving more and more away from Russia's interests. There is the ÷Copper÷ Program whose essence is the construction of an electrolytic copper plant of 90,000 – 100,000 cathode copper tpy capacity in Mongolia. The final objective is a full stop of output of saleable copper concentrate. Erdenet JV will supply refined copper to the world market and thus will become a direct competitor of the Russian companies. It is worth recalling that today Russia exports 70 % of home-made copper as cathodes, and this figure will unlikely undergo great changes in the foreseeable future.

CONTROL OVER RESERVES WILL NOT PREVENT DEPLETION

Ural Mining and Metallurgical Company is doing its utmost to strengthen the raw materials base of its own. It is establishing control over the sources of raw materials through the acquisition of mining assets. Starting from 2001, UMMC incorporated the Ural's largest producer of copper concentrates – the Gaisky Mine & Concentrator. Recently an acquisition of a large stock of shares (38 %) of another raw materials producer, the Uchalinsky Mine & Concentrator, which makes 48,000 – 50,000 tpy of copper in concentrate, was announced. Apart from it, the holding is the owner of the Safyanovsky copper deposit with 900,000 tons of Cu in total reserves. After the construction of a concentrating plant is completed the project capacity will be 30,000 tpy of copper in the concentrate. There are also several small deposits which mining will permit an output of 25,000 tpy of copper.

UMMC's managers do not cherish illusions. They are aware that the raw materials balance cannot be sustained in this way for a long time. Andrei Kozitsyn admits that the large-scale shutdown of mining facilities owing to the depletion of the deposits can begin as soon as in the 2010s. There is another real danger, which is closer. By Kozitsyn's words, 30 to 35 % of raw materials requirements for the UMMC copper production operations are provided for by scrap. Today it is possible because secondary materials are circulated mainly in the home market. But if Russia, on its entrance to WTO, has to cancel high export duties on scrap and waste of nonferrous metals a substantial part of these resources will go from the country. The shortage of raw materials will be insuperable.

Udokan with 20 million tons of copper is in the distant hard-to-reach area of Siberia.

|

|

As Andrei Kozitsyn believes, in the case of concatenation of unfavorable circumstances the copper output will have to be reduced by 200,000 tons. It will be an uncorrectable loss. A large-scale shutdown of production operations at copper plants can influence the life of several towns with a total population of over 300,000 people. By UMMC's estimates, ÷about 30,000 jobs will be lost in Ural÷. A special program for softening social consequences will have to be set up, with enormous subsidies for new jobs, retraining and unemployment benefits. Thus, Andrei Kozitsyn concludes, this problem ÷has already gone beyond the scope of one company, becoming a national concern since it refers to entire regions÷.

UDOKAN HAS BEEN AWAITING FOR THIRTY YEARS

The only possibility to avoid an unfavorable development of events, as UMMC's managers think, is to get down to the mining of Udokan, the largest Russia's copper deposit, as early as possible. The deposit contains around 20 million tons of copper which amounts to 58 % of predicted reserves of this metal in this country (or 40 % of reserves prepared for mining). The deposit is still untouched because of being located in the hard-to-reach area of Eastern Siberia.

The plans on mining Udokan were under consideration as far back as thirty years ago. But at that time an alternate decision was taken – to build the Erdenet works. The USSR input around US$500M into the set-up of the mine & concentrator in Mongolia. The main objective was not a secret – to promote further strengthening of Soviet influence in that country. Andrei Kozitsyn feels sorry that at that moment ÷politics commanded the economy÷ because the world situation has undergone radical changes, and the old ÷political decision is now working against the economic interests of Russia÷.

The Soviet state lacked efficiency and funds for Udokan, none the less, a large part of problems dealing with infrastructure was solved. It was the 1970s when the Baikal-Amur main line (BAM), which passes as near as 26 km from the deposit, was for the most part built.

For several years Ural Mining and Metallurgical Company has been studying variants of mining Udokan and now it has at its disposal a well-adjusted computer model. According to Andrei Kozitsyn, the company is willing to construct the first stage of the mine & concentrator of 15 million tons of ore in capacity over a period of four years. The company is able to attract US$250M as investments, which would pay back in seven-eight years, at today's copper prices. The second stage similar in capacity could be a further development of the project. A set-up of a larger industrial complex comprising metallurgical operations is economically unsound, in the opinion of the company's experts. The impartial obstacles are multiyear permafrost, distance, seismic conditions, sparse population. (The UMMC's plans regarding this deposit are described in more detail in ÷Eurasian Metals÷, No.1, 2002, p.14).

|

|

Ural Mining and Metallurgical Company incorporates 22 enterprises, whose majority is united into a single complex of copper production and processing. Among them there are a lot of open pits, 2 mines & concentrators, 4 copper smelteries, a refined copper plant, a copper wire rod plant, a copper and copper alloys rolled products plant, 2 radiator plants, 2 cable & conductor plants.

|

| |

|

It is the third year that UMMC is unsuccessfully trying to get a mining licence for the Udokan deposit of cuprous sandstone. Irrespective of three requests by President Putin, up to now the state structures cannot come to an agreement. The official dispute deals with the method of granting a licence. It may be a bidding when the commission assesses a whole set of technical, economic and social factors in the tender projects submitted by bidders or an auction where the winner will be an entity that will offer a higher price. The administration of the Chita Region (Udokan is in its territory) and the Ministry of Industry, Science and Technologies propose to make a choice during the bidding. The Ministry of Economics and the Ministry of Mineral Resources would prefer to attract an investor with more ambitious programs and therefore they advocate an open auction. In the last case it is very likely that the largest Russia's copper deposit will pass into the hands of a foreign company.

Erdenet. Open pit mine

|

|

THE FOREIGN INVESTOR WILL TURN HIS BACK ON RUSSIA

Apart from UMMC, Kazakhmys, a corporation that unites the entire mining and production of copper in Kazakhstan, makes an open challenge for the mining of Udokan. The historical paradox is that only 12 years ago the copper plants of Ural and Kazakhstan (then parts of a single industrial complex) were under common management while now they are in stiff competition. Kazakhmys has a powerful political support. According to reliable information sources, President Nursultan Nazarbaev assists the corporation in its claim. The copper production operations in Kazakhstan are fairly well balanced. Kazakhmys' top leaders state in their application to one of Russia's vice premiers that the corporation's captive reserves of copper minerals will be enough for 60 – 70 years. That is why it requires Udokan only as business which aim is an early and profitable return of investments.

Andrei Kozitsyn believes that ÷the hope that a foreign company will mine ore and supply it to our copper smelteries is illusive, to put it mildly. The investor will always have own interests in the world market, and they are far from the Russian priorities÷. Kozitsyn has no doubts that Kazakhmys would prefer to sell the Udokan concentrate to China at higher prices than LME ones. Besides China, in the same region there are other very attractive markets – South Korea or Japan.

Among the Udokan contenders there may appear Norilsk Nickel, as UMMC's General Director thinks. This giant is now striving at a rapid pace to buy mineral resources bases and mining facilities. For the last half a year it acquired the controlling stock of shares of Stillwater Mining Company (USA), became the owner of Polyus (Russia) gold miner and took on lease a deposit of Ti-Zr sands in Central Russia. There are no objective hindrances that will prevent this company from showing some interest in the mining of Udokan. ÷It is a business activity close to them÷, says Andrei Kozitsyn referring to the specialization of Norilsk Nickel, where copper occupies an honorable position along with nickel, cobalt and platinoids.

At the same time Kozitsyn rules out the possibility that Codelco will participate in the Udokan project. Last year UMMC carried on a round of discussions with the statesmen and business representatives of Chile. But, according to Kozitsyn's words, only the outlook for cooperation in metallurgical operations was touched upon. ÷In the coming decade Codelco will focus on the development of the Chile's copper industry and, in particular, will build a copper electrolysis complex of over 1 million tpy capacity. Because of it, they do not intend to invest in mining operations anywhere. This Codelco's standing was clearly confirmed during the discussions÷, reported Andrei Kozitsyn.

If, regardless of all objections, foreign participants get the right to claim the Udokan licence the outcome may be quite unexpected. Kozitsyn presumes that under the results of the auction not Kazakhmys at all but Chinese copper producers will take the first place. It is the Chinese companies with metallurgical operations greatly surpassing raw materials capacity that are particularly interested in such a big source of copper minerals in the adjoining territory.

At last, one cannot rule out the variant that the winner will simply ÷freeze÷ the project. The world copper market is oversaturated, and cooling the production is a good method to preserve a reasonable price level. ÷If it is ensured that the market will not have another 100,000 – 150,000 tons of copper every new year it may be a source of earnings as well÷. This supposition may be polemical but grounded. There is a negative practice of Udokan licensing. In 1992 the right for the mining of the deposit was obtained by the company with foreign capital. It was idle for eight years till the licence was revoked.

PROCEEDS FROM COPPER PROCESSING WILL EXCEED ANY LICENCE FEE

So, two radically different patterns to involve the Udokan copper deposit into operation are proposed.

The first one implies a short production cycle – only ore mining and dressing – with further sales of copper concentrate in the external market. The second one deals with intensive processing of copper-bearing raw materials in the territory of Russia, including an output of value-added and finished products – wire rod, copper powders and parts on their base, cable and conduits, tubes, radiators, etc.

When advocating the second pattern, UMMC's managers argue that it is in full conformity with the interests of the national economy.

Above all, Russian legislation defines the notion of ÷strategic reserve÷ that cannot be given into the hands of foreign companies. It is over 30 percent of the reserves of this metal in the interior of this country. The Udokan copper deposit is undoubtedly attributed to the above category, and its sale to a foreign investor will never be faultless from the legal viewpoint. The inconsistent behavior of the governmental officers is also alarmimg. For example, late in 2002 the Slafneft oil company's shares that belonged to the state were sold. Foreign participants were not admitted, despite the most profitable offers of Chinese companies who were ready to pay a much greater amount than the one announced according to the bidding results.

Then comes the next argument. ÷A lumpsum auction fee, never mind how large it may be, let it be even US$100 or 200M, is incommensurable with the potential tax incomings in case the raw materials are processed by the entire cycle available at our facilities÷, affirms Andrei Kozitsyn. The specialists of UMMC have already made respective calculations. If, as is supposed by Kazakhmys, only 13 – 20 % of the Udokan copper concentrate are to be delivered to the Russian plants and the balance to export, Russia's state budget will be in annual short supply of US$31M or 50M in the case of a 10M or 20M tpy capacity of the mine and concentrator to be built, respectively. The tax losses for Russia (with the existing taxation rate) will be over US$3bn for the whole period of the deposit mining.

The general director of UMMC also invites to take into consideration Russia's potential damages due to the loss of its share in the refined copper market, along with the lost profit of plants and heavy social consequences owing to mass redundancies as a result of lower supplies of copper raw materials to Ural. That is why the managers and shareholders of UMMC cannot agree to granting the licence through auction and insist on the bidding process.

An annual tonnage of refined copper output in the CIS can be estimated at 1,400,000 tons. The copper sector is, for the most part, represented by large companies with a captive raw materials base and an integrated cycle.

In RUSSIA Norilsk Nickel is the leader of the mining & metallurgical complex. The company's management supports the development and modernization of its copper operations though copper does not occupy leading positions in the company's activities. In the experts' opinion, their reserves prepared for mining will be enough for at least 60 or 70 years of operation. In 2002 Norilsk Nickel produced 454,000 tons of copper (474,000 tons in 2001), with 354,000 tons for exports (421,000 tons in 2001).

The second place in production tonnage is occupied by Ural Mining & Metallurgical Company, whose output in 2002 was 330,000 tons (324,000 tons in 2001).

Another copper producer on the primary minerals base is the Kyshtym Electrolytic Copper Plant, which, like UMMC, is supported by the raw materials resources of the Ural deposits. In 2001 this plant produced 82,000 tons of refined copper, with 76,000 tons in 2002.

In KAZAKHSTAN all enterprises of the copper complex are amalgamated into Kazakhmys Corporation. Alongside copper open pits, mines & concentrators and copper smelteries, the corporation has captive coal-mining undertakings and electric power stations. Kazakhmys mines about 40 million tons of copper ore per year and produces 410,000 of copper in the concentrate. It is planned to invest over US$100M every year for the development of the ore base and the modernization of concentrating plants and copper smelteries. In Kazakhstan the mining of two new deposits was already started, with another four (where construction and sinking operations are under way now) on the waiting list.

UZBEKISTAN has proven commercial copper reserves of 18.2M tons. The ores are sulfide and copper-porphyry, free-milling, the copper recovery rate is from 75-80 to 80-85 %. The copper production operations incorporate two open mines, a concentrator, a copper smeltery. They are included into the Almalyk Mining & Metallurgical Complex. In 2002 its output was estimated at more than 90,000 tons of refined copper. The modernization program of US$347.5M in cost involves, in particular, the reconstruction of the copper smelting operations and the construction of a nonferrous metals processing plant.

|

|

|

back

back