|

| Magazine |

|

| About |

|

| SUMMIT |

|

| Contacts |

|

| Home |

|

|

|

|

|

| |

|

|

|

| #2' 2003 |

print version |

|

|

ALUMINUM EXPORT: LOSS OF POTENTIAL PROFIT |

|

Igor Prokopov

President, Association of Russia’s Aluminum Producers-Noncommercial Partnership (Aluminum NCP)

n 2002 the Russian aluminum business managed to maintain its stability thanks, first of all, to large vertically integrated companies that were set up in the preceding years. The integration permitted to take economically effective steps and, in particular, to improve the management structure and reduce business risks through an accelerated development of the raw material process stage. For example, the company Russian Aluminum was given an opportunity to manage the Nikolaevsky aluminous plant in the Ukraine as well as the bauxite-producing complex and aluminous enterprise in Guinea. After the completion of building Russia’s first private railroad the company SUAL-Holding put into operation a mine at the Sredne-Timanskoe bauxite deposit (in the North-East European part of Russia) and started preparatory works on a large-scale project of producing alumina on the basis of this deposit.

The modernization of electrolysis shops and shops for preparing anode mass, which was undertaken practically at all aluminum-producing plants, permitted to significantly reduce costs of production and its power intensity as well as to cut down discharges of toxic substances into the atmosphere. In the last three years both production process stages, electrolysis and aluminous, have shown the best technological results in the whole history of the Russian aluminum industry. Companies invested considerable funds in reprocessing aluminum. They succeeded in raising the technical and technological levels of this production process, in making it profitable as well as in optimizing the structure and quality of commodity output in accordance with market requirements.

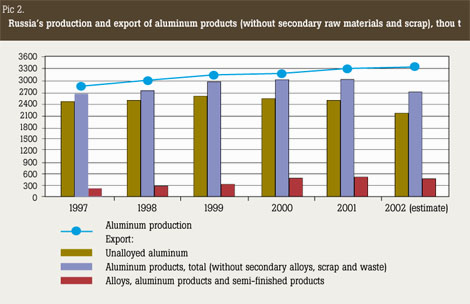

At the same time the aluminum industry is still facing problems, which negatively influence the development of this sector of the Russian economy. The total volume of exported products has been decreasing for the third year in a row. Leading economic indicators are quite modest and the profitability level is low. Above all, it is explained by low prices in the world market. In 2002 the average annual price of primary aluminum according to the LME quotations fell down to $1,350 a ton, the lowest level in the last eight years. This is $100 less than in 2001 and $200 less than in 2000. Meanwhile, prices for resources and transportation tariffs in Russia went up. Changes in the exchange rate of the Russian currency are lagging behind rates of domestic inflation. It is another reason for a continuous drop of exporters’ revenue.

It is necessary to keep in mind that major facilities for producing aluminum are located in Siberia and the Urals, i.e. far away from world trade routes. Companies are spending considerable funds for transporting and servicing cargo in ports. They also should pay import duties on bringing raw materials in and export duties on shipping products abroad. As far as Siberian aluminum plants are concerned, additional expenses of this kind range from $100 to $150 a ton.

In this situation shipments to foreign markets become less profitable. The export of primary aluminum has already decreased 15 %. The structure of the Russian export consists now of primary metal, alloys and semi-products with a small added value. The most serious obstacle on the way of advancing products with a high degree of preparedness is the protectionist policy. Western countries protect their markets with import duties and quotas because they have their own free capacities to reprocess aluminum.

As compared with sales of aluminum in the domestic market, its export today is less effective for Russia’s economy. That is why expanding the country’s market is becoming the paramount task.

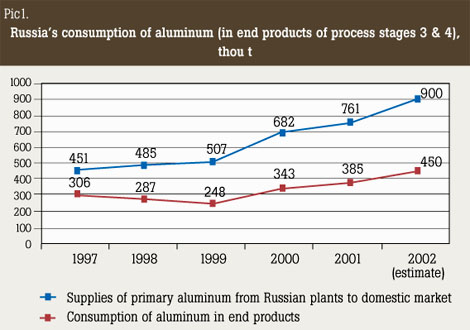

In the last years the consumption of aluminum in Russia increased by 1.5 times but it remains low anyway. Although about 20 kg of aluminum are produced now per capita, its consumption amounts to only 2.7 kg per capita (for Western countries the figure is between 25 kg and 40 kg). Theoretically speaking, reprocessing of aluminum, which is exported today, could raise production by an additional $15B, including the added value equaling $5B, and create more than 1 million new jobs. But today this potential is being realized outside Russia.

|

|

By experts’ estimates, results for 2002 in the Russian aluminum industry can be considered positive. The production of primary aluminum increased 1.4% while the production of alumina grew up by 2.8%. Also, the output of aluminum semi-products and articles jumped up by 5.9 %. The Uralsky aluminum plant of SUAL-Holding achieved the biggest increment of aluminum production that equaled 2.1 %. In its turn the Achinsk integrated mill (the company Russian Aluminum) raised the production of alumina by 7.3 %. The Bratsky aluminum plant, which remains the world leader, maintained its production of primary aluminum at the high level of over 900,000 tons.

Among aluminum-reprocessing enterprises the Saynskaya Folga plant and the Samara metallurgical plant reached the highest growth rates of 14% and 12.5% accordingly. The production of cans for soft drinks by Russian plants increased 33 %.

|

| |

|

There are two possible ways to redirect produced aluminum to the domestic market:

– through setting up new enterprises and developing the existing ones, which manufacture products with high added value using structural aluminum materials;

– through raising the domestic production of high-quality semi-products and articles by Russian aluminum companies.

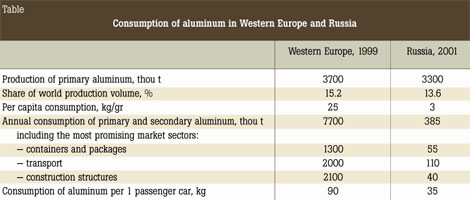

We are trying to ensure incentives for making the use of structural aluminum materials one of the priorities of the Russian government’s industrial policy. Yes, so far the demand for metal products is low. But the case with aluminum proves that it is not so much the reason as the consequence. Let us compare the most capacious, promising markets: in Russia volumes of using aluminum to make containers and packages, means of transportation, construction structures, etc. are 20 to 50 times lower than in countries of the European Union.

The purposeful stimulation of developing this production direction on the basis of new technologies would additionally provide not only a significant increase of the GDP volume and new jobs but also saving of energy resources, foodstuffs and traditional construction materials as well as reduction of toxic discharges into the atmosphere. To this end we are putting forward our recommendations for changes in the state policy. In particular, we are proposing to reestablish investment allowances for profit taxes, to permit the use of tax deferral for the period of developing a new production, to introduce state standards, technological norms and quotas on similar products made with outdated technologies as is the case in the U.S., Canada and the EU. There is a need to encourage setting up reprocessing production facilities based on using new technologies and structural materials.

There is also another possible direction of business activities. Aluminum companies make considerable investments in developing production of various articles. However, their ability to invest in such a production is limited. Estimates show that in order to successfully implement such projects (by the way, the same is also true for projects of developing a raw material base, of modernizing the existing production facilities) aluminum companies need to have no less than a 12% to 15 % return of net gain on receipts. In recent years this index fluctuated between 2% and 4%. With such a level companies cannot count on attracting long-term credits while they obviously lack their own funds.

The comparison between volumes of investments by Western and Russian companies in modernization and development of production facilities is far from being in favor of the latter. For example, the annual volume of investments by Alcoa and Alcan in production modernization and development amounts to between 6% and 9% of sales proceeds. As for Russian companies this figure is not higher than 3 %. The reason is different "rules of the game".

1. By introducing extra duties on the aluminum industry (like customs tariffs, for example) the government of the Russian Federation does not take into account the situation with prices in world markets. In the last 8 years the trend of world price movement went down by about $300.

2. Raw materials brought to Russia for producing aluminum, are taxed while in other countries, which make this metal, import duties on raw materials are not used.

3. Exporting countries practically do not apply export duties on aluminum but they are still in effect in Russia. On the contrary, there are import duties on aluminum in most countries, which are the largest consumers of aluminum. As a result, duties on Russian export of aluminum are imposed both ways.

4. The burden of taxes on business in Russia (taxes, dues and allocations to off-budget funds) is much heavier than in many other countries.

5. The complicated system of currency regulation creates unfavorable conditions for export and import operations, diverts additional financial resources and raises finance charges.

6. Tariffs and prices for transit by rail freightage as well as for energy resources tend to grow constantly and unpredictably.

7. The procedure of returning value-added tax to exporters adopted in Russia diverts considerable financial resources from companies’ working capital and, thereby, raises their finance charges.

The revision of outdated rules will give companies an opportunity to increase the profitability and to release additional funds for investments in producing aluminum semi-products and articles. The growth of profitability will make new projects in the aluminum industry more efficient and attractive to investors.

Transportation and energy expenditure in the Russian aluminum industry accounts for about 40% of through expenses on the prime cost. In the world practice energy tariffs for the aluminum industry are usually lower than for most other industrial consumers of electric power. And this is justified by those advantages that electric power producers get from aluminum plants as major and stable consumers. There is no such a practice in Russia. Aluminum business lobbyists see a possibility to change things by using draft laws on reforming RAO UES (the Russian joint-stock company Unified Energy Systems), which are being debated in the State Duma, the lower house of the Russian parliament. They are trying to stipulate a provision that would provide companies with an opportunity to acquire electric power generating capacities for their own needs and to subsequently include them in their structures. This would mean real investments in modernization and development of the country’s electric power engineering industry.

|

|

|

|

|

|

current issue

previous issue

russian issue

|

|

back

back