Alexei Sukhoruchenkov

Vice President, the Union of Mining Industrialists of Russia

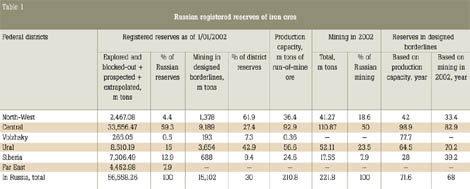

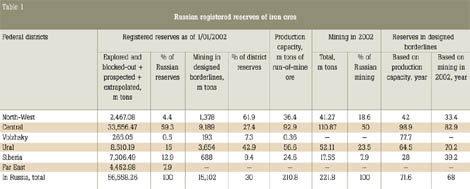

he Russian iron-ore base is composed of the registered explored and blocked-out, prospected and extrapolated reserves of 56.6 billion tons with an average Fe concentration of 35.87 % and the inferred reserves of 44.2 billion tons.

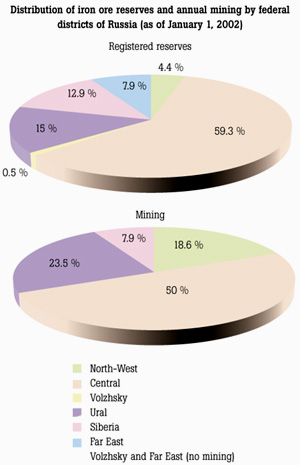

The data on the federal districts of Russia (see the figure) evidence that the greater is the reserves level the larger is the mining. At the same time, the total reserves of the North-West District, the lowest among the main areas in actual value, are mined at a higher rate. Meantime the reserves of the Siberian district, a three-fold figure in total, are mined much slower, and the Far East reserves, twice larger than in the North-West, are not mined at all.

If Russia in general is thought well provided for by iron ore reserves in designed borderlines of mining operations, the situation at individual enterprises is different. For example, the Olenegorsky Mine & Concentrator, with reserves for 12 years, will probably have to set up an underground mining complex, and the Kovdorsky Mine & Concentrator, with reserves for 25 years of operation, is likely to deepen the open pit without expansion of the upper horizons beyond the designed borderline. The Korshunovsky Mine & Concentrator is provided for with proven reserves only for 21 years and its further operation will depend on the mining of new Siberian deposits.

The Central Federal District, most industrialized and productive, is considered to be best provided for with reserves in designed borderlines of mining operations as well. It has the world largest iron-ore basin, the Kursk Magnetic Anomaly. In this region the reserves of the Mikhailovsky, Lebedinsky, Stoilo-Lebedinsky, Stoilensky and Korobkovsky deposits are mined; an underground mine is being constructed to extract the ores of the Yakovlevsky deposit. Here the test operations to mine the rich iron ore by deep-hole hydraulic operation in the Shemraevsky section of the Bolshe-Troitsky deposit. These rich hematite-martite ores require concentrating with lean ferruginous magnetite quartzites.

The abundant but deep-seated and water-containing iron-ore reserves of the Kursk Magnetic Anomaly are difficult for mining. Moreover, the famous Russian chernozem (black soil) lands (a highly-productive top soil) are situated here, so the development of mining operations is restricted.

In the North-West District, the Olenegorsky, Kirovogorsky, Baumansky, Kostomukshsky and several other deposits have ferruginous magnetite quartzites, the Kovdorsky deposit, apatite- baddeleyite-magnetite ores. All of them require concentrating.

In the Volzhsky District, the iron ores are for the most part the limonites of the Tukansky deposit (the Zigazino-Komarovsky group with 70.2m tons of total reserves with an average Fe content of 39-42 %) and the Fe-Ni ores of the Orsko-Khalilovsky region with 194.7m tons of total reserves with an average Fe content of 30-40 %. At present the ores are not mined here.

In the Ural District almost all explored iron-ore reserves are easily-concentrating titanomagnetites. The largest deposit of this type is the Gusevogorsky field mined by the Kachkanarsky Mine & Concentrator. The average metal content is 16.5 % Fe, 0.15 % V, 1.25 % Ti.

In the Siberian Federal District for the most part easily-concentrating magnetite ores are mined at the deposits of the Irkutsk and Kemerovo Regions, Khakassia and the Krasnoyarsk Territory. In East Siberia there are the Charsky deposit with 299.4m tons of ferruginous magnetite quartzites with a 27 % Fe content and the Chineysky deposit of titanomagnetite ores with 936.5m tons of extrapolated and inferred reserves with a 33.5 % Fe content. Both deposits located in a distant area need big investments in concentrating and infrastructure.

In the Far East District the explored reserves have not been mined as yet. They are for the most part magnetite ores and magnetite ferruginous quartzites. The ores of the Desovsky and Taezhny deposits require complex processing flowsheets. The ores of the Tarynnakhsky and Gorkitsky deposits (the Charo-Tokkinsky area) are easily-concentrating magnetite quartzites of 2,064.6m tons of total reserves. In the Amur Region there is the Garinsky deposit of magnetite ores of 388.8m tons of reserves with a 41.7 % Fe content.

At present the Russian iron-ore mining enterprises are fully controlled by private capital.

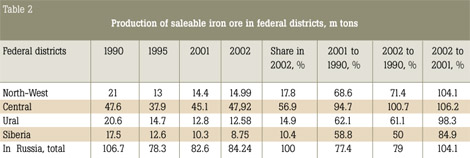

Despite a considerable reduction of output of saleable iron ore in the last decade as compared with the record figures of 1990, the demand of steel works and plants for iron ore materials is fully met on the whole. The exports of iron-ore concentrate and pellets were 13.4m tons in 2002. Besides, 900,000 tons of HBI was supplied for export.

In general, the output of saleable iron ore grows but at the same time a change in the ratio of different regions takes place. Thus, in 2002 in the Central District 56.9 % of the total national output was produced against 44.6 % in 1990. At the same time, the share of the other districts was as follows: North-West, 17.8 % (against 19.7 %); Ural, 14.9 % (19.3 %); Siberia, 10.4 % (16.4 %).

The greatest fall is observed in Siberia where small enterprises mining thin deposits operate in the main. The distant location of the enterprises, indefinite ownership, absence of efficient management structure predetermined a drastic drop of investments and decrease of production capacity.

Open mining accounts for the major part of iron ore production. But every year the geological and technical conditions of mining operations become more and more complicated, and the pits deepen (the main factor of increasing costs). The weighted mean depth within the closed contour of the large open pits (the Olenegorsky, Kovdorsky, Kostomukshsky, Mikhailovsky, Lebedinsky, Stoilensky, Kachkanarsky and Korshunovsky Mines & Concentrators where 87.5 % of the Russian iron ore is mined) increases fairly rapidly:

| 1990 | 178 m |

| 1995 | 197 m |

| 2001 | 259 m |

| Total in 11 years | 81 m |

|

|

As Russia, other CIS countries have own iron-ore bases for steel industry. Ukraine has the Krivoy Rog Basin with large reserves of rich iron ores requiring concentration with lean ferruginous magnetite quartzites. Ukraine accounts for about 30 % of the total iron-ore reserves.

In Kazakhstan the iron-ore base has in the main scarn magnetite ores of the Sokolovsko-Sarbaisky and Kacharsky deposits as well as big deposits of limonites, Lisakovsky and Ayatsky. This country share is 8 to 9 % in the total CIS volume. For the most part, the Kazakh ores need concentrating.

Small deposits of iron ores are also in Azerbaijan, Armenia and Tadzhikistan.

|

| |

|

The biggest iron-ore pits reached even larger depth: Olenegorsky, 290m; Kovdorsky, 294m; Mikhailovsky 280m; Stoilensky, 284m; Lebedinsky, 330m. The big pits will operate till a depth of 500-800m is reached.

|

back

back