|

| Magazine |

|

| About |

|

| SUMMIT |

|

| Contacts |

|

| Home |

|

|

|

|

|

| |

|

|

|

| #2' 2003 |

print version |

|

|

MARKET FOR COPPER ROLLED STOCK: PROSPECTS ARE GOOD AND INTERNATIONAL INVESTMENTS ARE RECOMMENDED |

|

Yuri Raikov

General Director, Institute Tsvetmetobrabotka

he Russian industry of producing metals from copper and its alloys consists of two groups of enterprises: wire-and-cable plants and non-ferrous metal treatment plants.

By volumes of copper consumption the electrical industry is the leader that uses it to manufacture current conductors, power cables, magnet and enamel-covered wires, communication cables, flexible cords for home equipment. All these are products of the cable enterprises, which altogether consume from 45% to 48 % of all copper.

Cable products are manufactured from copper rods, which are made at the plants Katur-Invest JV (Sverdlovsk region), Elkat (Moscow), Rosskat (Samara region), Transkat (St. Petersburg) and the Kyshtym Electrolytic Copper Plant. The latter one also produces wire from oxygen-free copper at the Up-Cast type unit made by the company Outokumpu.

Many Russian wire-and-cable plants use from 40% to 45% of rods to make magnet wire, including fine and enamel-covered wire. The rest of rods are used for producing insulated wire, power cables, communication cables and other current conductors.

The Russian industry of heavy non-ferrous metals numbers 10 plants. They produce a wide range of flat sections and rounds from copper, nickel, zinc and their alloys.

After the significant decline that lasted almost a decade the production of rolled stock started to grow. In the first quarter of 2003 its production volume increased 26.9% as compared with the first quarter of 2002.

The growth of Russia’s GDP prompted the increased demand for non-ferrous metal rolled products. Their leading consumer is the engineering industry (from 40% to 50% of the total consumption). It is predicted that in the nearest three years rates of the further growth in this sector of the economy will average between 5% and 6% a year.

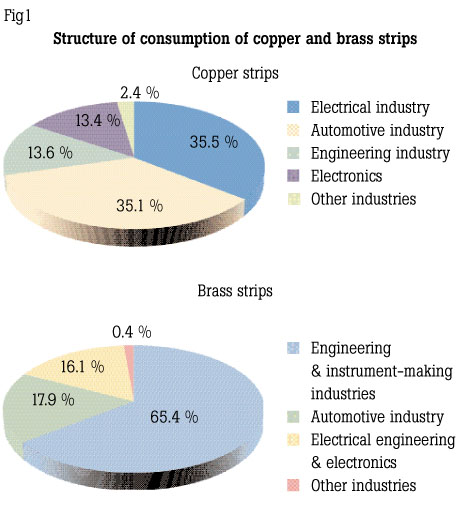

Flat sections, i.e. strips, sheets, bands and foil, are the first among all other semi-finished products (from 45% to 50% of the total production volume). Fig.1 shows the structure of the copper and brass strip consumption in Russia. A significant part of flat sections goes to the Russian automotive industry, which uses them mainly in production of engine-cooling radiators for motor vehicles and other heat exchangers. By 2005 Russia’s production of passenger cars (taking into account new JVs) will increase as much as 1.3 to 1.5 times. And by 2010 their production is estimated at 1.9 to 2.2 million cars. The copper consumption by this industry will grow accordingly.

The following enterprises are the leading suppliers of flat sections to the automotive industry: the Kirovsky and Gaisky plants (copper and brass strips for radiators); the Kolchuginsky plant (bands for synchronizers); the Moscovsky plant (bronze strips and bands); the Krasny Vyborzhets (copper rolled stock).

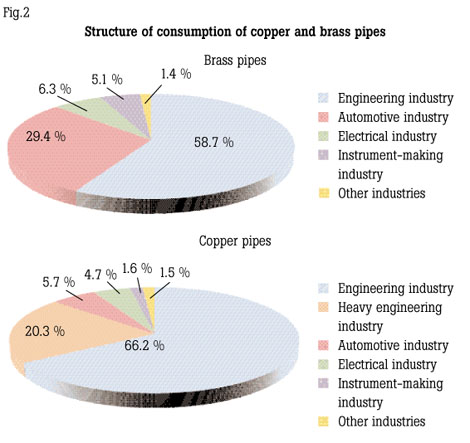

Rounds (pipes and bars) are consumed mainly by the engineering industry (Fig.1 and Fig.2). Brass pipes are intended for heat-exchanging devices, which are used in condensers at thermoelectric power stations, in boilers of heating systems, at enterprises of the chemical and sugar industries.

In the last 10 years practically no new generating capacities have been put into operation at electric power stations. The service life of condenser pipes averages 10 years. They should be replaced after that. So, annually up to 9,000 tons of brass and copper-nickel pipes are required for their replacement. Since electric power specialists started replacing pipes only in the last 1.5 to 2 years, the consumption of brass pipes jumped up 43% just in one year and the use of copper-nickel pipes rose many times over. This trend will grow stronger in future years.

Russia accounts for the world’s highest percentage of buildings with district heating. Heat networks of its housing and communal services extend to 146,000 km. Brass heating-water pipes, the most important element in introducing heating systems, need a systematic replacement but in the 1990s it was almost never done. The annual need for heating-water pipes reaches 7,000 tons.

The Russian building industry is also a promising market of copper pipes. This is proved by the world experience of mass use of copper for water pipelines, gas pipelines and air conditioning. In 2000 volumes of copper pipe consumption for these purposes were as follows: water and gas pipelines accounted for 900,000 tons; 500,000 tons were used for air conditioners and refrigerators; 240,000 tons went to making different structures.

This market has not showed its worth in Russia yet. At present, copper pipes for water pipelines (they are made by the Revdinsky and Kolchuginsky plants) have a limited use. In future sanitary engineering pipes of 6 mm to 22 mm in diameter (covered with polyvinylchloride and elastomer) may be used on a large scale. They have an indisputable advantage over standard copper pipes, the use of which lead to considerable losses of heat.

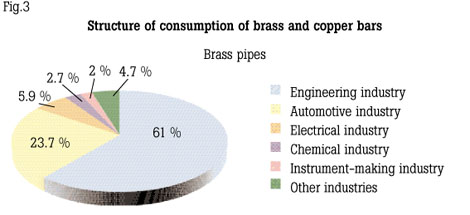

Brass and copper bars for cutting and stamping are used mainly in the engineering and instrument-making industries (Fig.3), which are to be developed in Russia at accelerated rates. Right now production capacities of engineering plants are underloaded: machine-tool plants by 13%, bearing plants by 35% and electric-machine plants by 23%. Potentially, this is an enormous market. Taking into account the fact that the service life of equipment in the Russian industry as a whole exceeded 14 years, there will be a need in the coming years to sharply increase spending on modernization. It will boost the engineering industry’s demand for brass and copper bars.

|

|

|

Yuri Raikov

General director of the Institute Tsvetmetobrabotka JSC. Born in 1946 in Tashkent (Uzbekistan). Graduated from the Moscow State Institute of Steel & Alloys, All-Soviet Academy of Foreign Trade and Fuqua School of Business (Duke University, the U.S.). Has a wide scientific and academic experience. Was an intern at the Beijing University of Science & Technology, has a scientific degree in engineering, full member of Russia’s Academy of natural sciences. In 1991 headed the joint scientific and engineering enterprise Materials & Technologies. In 1996 became the deputy general director and in 1998 the general director of the Institute Tsvetmetobrabotka JSC. Authored over 80 scientific works and inventions in technology and economy of non-ferrous metal treatment.

|

|

| |

|

The industrial upturn, which has been obvious in Russia in the last 2 to 3 years, has been accompanied by the increase in consumption of rolled products of copper, nickel and their alloys. The fastest growth is in consumption of copper wire and cables, semi-finished products for the automotive industry, power and heavy engineering industries, coinage, etc. The analysis of data on prospects and rates of development of the economy’s principal sectors as well as predictions by Western consulting companies make it possible to figure out several trends in consumption of semi-finished products of copper and its alloys.

Fast development of making semi-finished products used by the automotive industry (the finest high-precision copper and brass strips for radiators, brass bars of extra accuracy for cutting, bronze bands for bearings).

Expansion of producing copper pipes for air conditioners and water-pipe systems, including those with inner arcs, with plastic cover and with a surface cleaned by special methods.

Fast increase in consumption of fine strips of bronzes and copper-nickel alloys for electronics (personal computers, facsimiles, modems, cellular and radio telephones).

Decrease in unit consumption of copper semi-finished products by the engineering and machine-tool industries due to reducing equipment mass and using substituting materials (aluminum, stainless steel, plastics, composites).

Expansion of using copper-nickel alloy condenser pipes instead of brass pipes for thermoelectric and nuclear power plants because of the deteriorated chemical composition of cooling water in natural reservoirs and the need to renew equipment.

In the final analysis, volumes of sales of copper rolled stock will be determined by the ability of Russian producers to bring to the market products, which by their quality, variety and price level are to be highly competitive with the similar foreign ones.

|

|

|

|

|

|

current issue

previous issue

russian issue

|

|

back

back