|

| Magazine |

|

| About |

|

| SUMMIT |

|

| Contacts |

|

| Home |

|

|

|

|

|

| |

|

|

|

| #2' 2003 |

print version |

GOLD, GOLD, GOLD! |

| THE PRODUCTION OF PRECIOUS METALS IN THE POST-SOVIET ERA WHO CONTROL THE INDUSTRY? |

Anatoly Kochetkov

Doctor of Geology and Mining

| | The Olympiadinsky deposit in the Krasnoyarsk region |

ack in the Soviet era there were 12 regional gold-mining enterprises subordinated to a single managing agency. The largest among them were Yakutzoloto, Severovostokzoloto, Amurzoloto, Zabaikalzoloto and Lenzoloto. In 1990 the production volume of this industry reached its peak amounting to 302 tons of gold. Small prospecting cooperatives were also effective by using a relatively cheap fuel and equipment. The productive work of gold-miners much depended on the strong geological service, which received state funds for its prospecting activity.

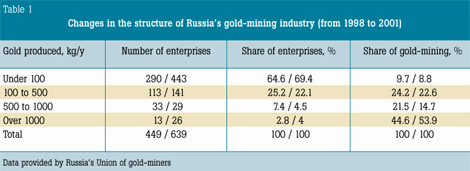

In the opinion of experts, the privatization of the gold-mining industry in the early 1990s was an absolute failure. It led to dividing available gold-mining sites and technical potential between hundreds of middle-sized and small enterprises. All in all, there were 634 of them in 2002. In many cases annual production volumes amounted to just a few kilos of gold. And, according to results of 2001, only 26 enterprises produced over 1 ton. The pattern is striking: fewer enterprises are producing more gold.

With world prices for this precious metal growing a tendency to structural transformations in Russia’s gold-mining industry became evident. As everywhere in the world, this process is going in several directions. Some companies are formed through joint ventures, some are set up as a result of taking over minor joint-stock companies and others use integrating several enterprises into holdings. The integrated companies keep expanding their activities and obtain long-term financing on favorable terms. They are trying to get licenses for new mining sites, including those, which are located beyond territories, where their main operations are concentrated.

In the opinion of well-known specialists of the gold-mining industry Sergei Kashuba, Valery Braiko and Valery Goncharov, now both the primary and secondary markets of gold-mining license circulation are being actively formed. The matter is that almost all significant deposits of vein gold in Russia have already been distributed and are at least partially being developed. That is, apart from several promising fields in the Irkutsk, Chita and Kamchatka regions, those deposits, which remain undistributed, are either unattractive or insufficiently prospected. Therefore, powerful gold-mining enterprises are seeking to acquire assets of weaker competitors that have licenses for deposits that have some potential.

By the volume of mined gold the company Polus has been the largest since 2001 reaching the production level of 15.6 tons. With the start-up of the second phase of the gold-extracting plant in 2002 the production volume there was raised to 25.5 tons. Recently Polus has changed hands and it now belongs to Norilsk Nickel JSC. The management of Norilsk Nickel regards this deal as an important step in its diversification strategy aimed at taking over key market positions. And, indeed, Russia’s largest producer of nickel, copper, cobalt, palladium and platinum has now become a leader in mining gold. It should be noted that Norilsk Nickel also obtains gold while reprocessing complex ores: the volume of this production amounts to 3.3 tons.

Polus produces gold by open-cast mining at the Olympiadinsky deposit in the Krasnoyarsk region. The company has also licenses for a number of other deposits. It intends to invest $1B in raising gold production. According to the chairman of Polus’ board of directors Valery Rudakov, in the coming 5 years this will permit the increase of the annual gold production up to 100 tons.

The Russian-Canadian gold-mining company Omolonskaya (Canada’s Kinross owns a 54.7 % stake) is developing the Kubaka deposit. In five years of the company’s operation there it produced about 100 tons of gold. The good quality of ores with the average content of gold equaling 18.4 % made it possible to maintain the high labor productivity. Till 2001 Omolonskaya was the leader in the Russian gold-mining industry. But now its production volumes are down because a considerable part of the deposit has been worked out and reserves are close to depletion. Recently a new deposit, Byrkachan, was discovered 50 km from Kubaka. If the company receives a license to develop it, Omolonskaya could extend its activity in this region for another 10 to 15 years. By estimates, up to 10 tons of gold might be produced there.

The Association Polymetal (MNPO Polymetal) set up in 1998, owns 7 mining and 6 auxiliary companies, which are operating in Russia’s main gold-producing regions (Buryatiya, Khabarovsk Territory, the Irkutsk, Chita and Magadan regions). The holding has 17 licenses for deposits of precious metals and prospecting areas and is Russia’s first for the production of silver. It is estimated that the total reserves (C1+C2) owned by MNPO Polymetal consist of 22,417 tons of silver and 205 tons of gold. In 2002 the holding produced 4.2 tons of gold.

One of holding’s subsidiaries is ZAO Zoloto Severnogo Urala (the closed company Gold of the North Ural, Sverdlovsk region) with the production volume of 3.3 tons (2002). The company attracted much attention because for the first time in Russia it applied the technology of the heap leaching in wintertime. So, it may be possible to produce precious metals on an all-year-round basis that just recently seemed unthinkable.

In 2 to 3 years MNPO Polymetal might take the second place in Russia for the gold production volume. In March it has become known that the Standard Bank of London has been arranging for the holding a syndicated loan of up to $120M. The expected credit line from a syndicate of international financial institutions will be the first project of this kind. The very fact of a Russian company cooperating with one of the world’s major banks is significant. It proves a growing interest of international capital in this sector of the Russian economy.

| | The Kubaka deposit |

The holding Lenzoloto was set up on the basis of a production association that was one of the largest in the Soviet times. Lenzoloto owns controlling blocks of shares of 15 gold-mining companies in the Irkutsk region and has its own geological prospecting subsidiary. The holding develops placer deposits and ore reserves near Sukhoy Log, the widely known deposit. In 2002 the total volume of gold production by the holding’s subsidiaries amounted to 7.5 tons.

The ore-mining and processing mill Susumanzoloto (the Magadan region) can also be considered a large enterprise. It incorporates several joint-stock companies, which altogether produced 5.8 tons of gold in 2002.

ZAO Mnogovershinnoye, which is the joint venture of the Russian company Rudnik Mnogovershinny and the Highland Gold Mining Ltd (HGM, the U.K.) and which operates in the Khabarovsk region, is developing the deposit of the same name. In 2002 it produced 5.7 tons of gold. According to the company’s leaders, its strategy is based on active investments in production, strict discipline and modern technologies. Funds that HGM received by floating shares of the JV on the London Stock Exchange have been used for developing technological processes at the Mnogovershinny mine as well as for developing four deposits in the Chita region. Besides, the company is prospecting for new ore deposits in Buryatiya as well as on Chukotka and Kamchatka Peninsulas.

Buryatzoloto JSC is regarded as a stable company. It has licenses for developing the gold ore deposits Zun-Kholba and Irokinda. With a low prime cost of mining there the company produced 4.8 tons of gold in 2002. It strategy provides for expanding production at the existing mines and prospecting for new large deposits. After having spent $4.7 million on geological prospecting works the company started to develop the gold and polymetal deposit Berezitovy in the Amur region. Buryatzoloto’s shareholders are High River Gold, Jipangu, EBRD and the Small Business Crediting Bank. The company’s shares are highly rated at the Berlin and Frankfurt Stock Exchanges. Buryatzoloto and High River Gold are forming through consolidation an international mining group with a diversified portfolio of quality assets.

ZAO Artel staratelei Amur (the close company Amur prospecting cooperative) is the leader in the Far East of the Russian Federation. Out of 4 tons of gold produced by this company in 2002 the major part was extracted from vein deposits. Amur owns about 40 licenses for gold deposits in the Khabarovsk region. The company is constructing mines, open pits, concentrating mills and modern production facilities for extracting gold from ore. Besides, Amur is engaged in producing platinum and expanding to other sectors of the economy, such as building materials, foodstuffs, household chemical goods.

ZAO Yuzhuralzoloto (produced 3.4 tons of gold in 2002) has licenses for two ore deposits with reserves that will take dozens of years to develop. Nevertheless, the company seeks to expand its activity. The company entered the gold market of Mongolia, where it intends to take part in developing explored deposits and to obtain a license for an independent prospecting.

Aldanzoloto JSC is the oldest and largest gold-mining enterprise in Yakutia. In 2002 the company produced 3.6 tons of gold from placer deposits and ores. By 2005 Aldanzoloto plans to put into operation a new gold ore complex at the Kuranakhskoye deposit with the annual production volume between 6 and 8 tons of gold.

The crisis situation in Russia’s gold-mining industry during the 1990s was especially felt in remote regions of Siberia and Russia’s North-East. Many gold mines in Yakutia were closed down and gold-miners’ settlements were liquidated. Southern Yakutia found itself in more favorable conditions though. In order to stabilize mining of gold there the joint-stock company Zoloto Nerungry was set up in 1996. At present, the company incorporates 18 gold-mining enterprises, which produced 4.2 tons of gold in 2002. At the end of 2002 the enterprise Nerungry-Metallic put into operation at the Tabornoye deposit a gold-extracting heap-leaching plant with the annual production volume of 1 ton of gold.

The only enterprise, which commercially produces ore gold in the Amur region, is Pokrovsky Rudnik JSC. In 2002 the company’s production volume amounted to 2.3 tons of gold. It also put into operation a plant for reprocessing gold-containing ore. The British Peter Hambo Mining Plc, which owns a 75% stake in Pokrovsky Rudnik, invested $45M in building this plant. This new production facility is designed to reprocess 1.6 million tons of ore and produce 5 tons of gold a year. The prime cost of producing ore gold there is one of the lowest in Russia.

In recent years experts started to pay more attention to the activity of the commercial bank Lanta Bank. This financial structure consolidates gold-mining enterprises through crediting. The bank began functioning as a holding. It implements investment programs connected with mining of ore gold and platinum-containing metals in the Chita, Irkutsk and Khabarovsk regions as well as in Yakutia. Some enterprises are already developing deposits. Programs of geological prospecting operations, construction, modernization and expansion of production capacities have been worked out for others. Lanta Bank invested $5.1 million in its own projects and it intends to invest another $2 million. In 2003 the bank plans to put into operation in the Irkutsk region a gold extraction plant with a production volume of 3.5 tons of gold a year. It is planned that, subsequently, this volume will be raised to 7 tons.

In 2002 the holding’s enterprises produced around 1 ton of gold. Lanta Bank also sells precious metals. In 2001 it acquired 21.9 tons of gold, of which 18.8 tons were exported.

With the start-up of the ore-mining and processing mill Juliet in September 2001 ZAO Omsukchanskaya mining technological enterprise became one of the leading companies in the Magadan region (it produced 3.4 tons of gold in 2002). The design capacity of Juliet is 3 tons of gold and 52 tons of silver while costs of production costs are optimal. The profitability is ensured by the high content of noble metals in the ore. Canada’s Bema Gold Corp. managed to attract $70M for implementing the Juliet project. Bema Gold received a license for geological prospecting operations on the territory of 225 square kilometers. The corporation hopes that new discoveries will prolong the mine’s viability.

The analysis of production and economic activity in the gold-mining industry proves that strong integrated companies have undoubtedly an advantage in contrast to small enterprises, even if they are very mobile. They are more transparent and enjoy confidence of creditors and investors. These integrated companies introduce modern technologies of mining gold, conduct their own geological prospecting operations and fulfill ecological requirements. In the future the importance of such companies for the Russian gold-mining industry will be growing. It will not result in a complete disappearance of small and middle-sized competitors. As long as there are resources of placer gold in Russia, there is also a room for prospectors. Deposits, which are of no interest to large companies, have been and will continue to be discovered. And their development is profitable for small enterprises.

|

|

|

|

current issue

previous issue

russian issue

|

|

back

back