Yevgeny Khokhlov, Vladimir Shlyomin

Metal producers are angry: the State is ignoring problems of their industry. Heads of Russia’s major metal producing companies said it repeatedly in recent times. It is well known that the immediate reason for such statements was the sluggishness of the federal government that did not get too much worried about the crisis in steel markets and did not offer adequate compensatory measures to protect domestic producers. However, as observers got convinced soon, this was just a particular manifestation of the generally adverse situation.

Indeed, the government of the Russian Federation does not intervene in the affairs of the metallurgical industry. The government simply avoids doing this because it does not have the necessary machinery and competent specialists on its staff. It has been the case since 1996 when Russia’s traditional executive structure was finally dismantled. The federal Committee for metallurgy was abolished along with other industrial control bodies. Instead, a multi-branch ministry of industry with uncertain functions and even less clear responsibilities was set up.

Concept ‘Prospects for developing Russia’s metals industry in the years till 2005’ was worked out deep inside the ministry at the beginning of 1999. Despite its promising title this document was nothing more than a mixture of abstract recommendations and fragments from federal programs adopted earlier but never carried out. It did not contain any obligations on the part of the State with respect to metal producing plants and did not make special demands either. Its only merit was a sense of optimism based on bureaucrats’ belief that volumes and efficiency of production would certainly grow. Of course, this concept was forgotten as soon as the work on it was completed.

At the same time it is true that metal producers themselves did not need protection from state structures. Companies were skillfully lobbying for corporate interests, they had their own development programs (and, unlike state programs, theirs were consistently being fulfilled), and were successfully overcoming difficulties caused, for example, by the wave of antidumping procedures or accelerated growth of energy tariffs. Thanks to comparatively low prices for their products many Russian enterprises found their niches in the world market and this gave an impression that the country’s metals industry was capable of developing by inertia, without interference of outside forces.

|

In the near decade much greater demand for seamless copper tubes and brass band is predicted in the Russian market. They are the products whose output is expected to be developed by UMMC at the Kirov Non-ferrous metals Processing Plant incorporated into the company |

High rates of production growth at metal producing plants distracted attention from mounting signs of its crisis. In 2000 the production growth reached 15 %. But already in 2001 the dynamics abruptly changed: the growth rates in non-ferrous metals industry dropped to 5 % and in steel industry the growth stopped dead altogether. The profitability fell down to a critically low level.

The situation was pushing metal producers toward cooperating with the State. This time around they did not miss an opportunity to take the initiative into their hands. Russia’s largest companies EvrazHolding, Russian Aluminum, SUAL, UMMC, Severstal and others took part in formulating a new concept of developing the country’s metals industry. Each of these structures not only has its own analytical departments but also maintains direct contacts with scientific centers, expert organizations. Therefore, they have sufficient current and projected data at their disposal. But the most important distinction from the ministerial machinery is that any company bears full responsibility within the area of its activities and in sum these companies account for a major part of Russia’s metals producing complex.

So, one can regard with high degree of confidence those predictions and estimates that the minister of industry, sciences and technologies Ilya Klebanov cited in his report «On measures to develop Russia’s metals industry and to secure its scientific and technological base in the years till 2010» at the session of the Russian government on May 16, 2002. The full report is available in Metally Evrazii magazine (No.3, p.4) as well as on site http://www.eurasmet.ru/unpublished.html (in Russian). Let us quote a few passages that describe prospects of the Russian metals industry.

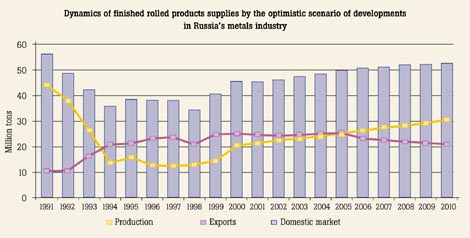

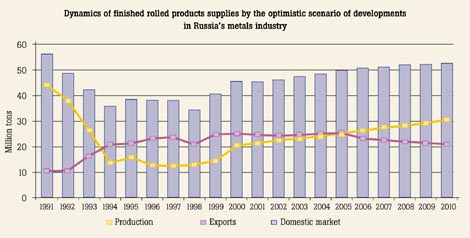

The concept is based on the presumption that in the years till 2010 a considerable share of Russia’s metal products will be exported and that the industry’s development will much depend on the world market conditions. Taking into account the inevitable intensification of competition and fluctuations of major markets, analysts conclude that export volumes will be going down. By their estimates, the export share of steel rolled products will amount to 50 % in 2005 and to 40 % in 2010; the share of base non-ferrous metals will equal 75 % and 65 % accordingly.

The report notes: «Russia’s metals industry is operating in the conditions of the global competition in the world market. Therefore, at this stage the most important direction of the state industrial policy in this industry is a creation of such general conditions for operation of the industry’s enterprises that would match those that exist for development of metals industry in countries being major participants in the world market of metals. Within the context of this task ensuring the competitiveness of Russia’s metals industry in the world market postulates implementation of a number of state measures in tax, customs and tariff policies as well as in foreign trade».

Ilya Klebanov

Minister of industry, sciences and technologies of the Russian Federation. Born in 1951.

Engineer-electrical physicist. Worked for 20 years at the Leningrad optomechanics association (LOMO), which he happened to manage in the years of transition to market economy, the most difficult period for most industrial enterprises. Proved to be a successful manager: labor productivity at LOMO increased 3.5 times as much and its profit grew up from $80,000 in 1992 to $16 million in 1997. Those employees, who worked with Klebanov at LOMO, stress not only his business grasp but also his benevolence, tact, humor, lack of arrogance. That is to say all those qualities that are characteristic of St. Petersburg’s natives. In politics also tries to be loyal to all people and so practically has no enemies.

In December 1997 became vice governor of St. Petersburg responsible for economic policy. On May 31, 1999 appointed vice premier of Sergei Stepashin’s government. Went on working with the governments of Vladimir Putin and Mikhail Kasyanov.

Tries to spend free time with the family. Has a 20-year old daughter, a student of the St. Petersburg university of economics and finance, and a 10-year old son, who goes to gymnasium.

| |

| |

|

Other important directions of the state policy in metals industry are related to expanding the domestic market, intensifying innovation activities, restructuring the industry and solving social problems.

In 2001 the domestic consumption of steel rolled products amounted to about 23 million tons. The structure of steel consumption is as follows: machine-building enterprises account for 11 million tons, 2 million tons of which are consumed by automotive plants, the capital construction’s share amounts to 3.5 million tons, the fuel-and-energy complex takes up about 3 million tons and 1.6 million tons go to the railroad transport.

The transport engineering industry consumes the major share of non-ferrous metals in the domestic market (from 30 % to 50 % of various metals). A significant growth may be secured through raising consumption shares of the construction (from 10 % to15 % to 20 % to 40 %) and defense industries.

The metal consumption growth is getting slow. In 2002 rates of increment in metal product sales in the Russian market will be down to 4 % to 6 % (steel rolled products) and to 5 % to 8 % (non-ferrous metals). What is more, if the neighboring countries (Ukraine, Kazakhstan) continue deliveries at dumping prices, results may be even worse.

In these conditions a set of measures to protect the Russian market is proposed. Besides, the government takes upon itself a responsibility to provide the country’s producers with orders for metal products when working out programs of modernizing the railroad transport, electric power engineering and gas industry.

|

Russia’s metals industry consists of about 3,500 enterprises with approximately 800 of them being large and medium-sized. As a result of privatization, 95 % of enterprises are transformed into joint-stock companies with insignificant blocks of shares belonging to the State. The total number of people employed in metals industry exceeds 1.4 million workers.

| |

| |

|

By estimates, up to $100 billion will be invested in PSA projects in the nearest 10 years. In spite of the existing law on PSA, which stipulates a preferential use of Russian products and services for these projects, foreign investors are making the best of legal gaps so as to employ resources of their own countries. Taking this situation into account, the Russian government intends to complete forming a normative and legal base soon to secure the share of Russian metal producing plants participating in PSA projects as provided for by the law.

The State commits itself to creating conditions for an accelerated development of main metal-consuming industries. The predicted growth of motor vehicle production twice as much by 2010 may lead to an annual increase of metal rolled products consumption by 2 million tons. The rise in sales of agricultural machinery through leasing will result in expansion of production in this sector of machine building and in a stepped-up annual demand for metals by 1 million tons more. Replacing worn-out pipes of municipal services and modernizing oil-and-gas pipelines will drive demand for steel up by 1.5 million tons. Getting more orders from the defense industry will partly revive production of special steels and alloys.

It is considered expedient to take specific measures of support, including state share participation in projects of setting up import-alternate production operations. The typical example of this is the construction of a large-diameter pipe mill in the city of Nizhny Tagil with a 25 % stake owned by the State. There might be a similar state participation (by the ministry of railways, for one) in producing railroad car wheels of new generation and other projects on the national scale.

In view of projected needs of the market there are plans to accelerate manufacturing the following products:

– galvanized automotive sheet of the higher formability;

– high-strength welded pipes of 1420 mm in diameter with insulation coating;

– railroad rails for high-speed traffic;

– microalloyed boron-containing steels for die forging of high-strength fasteners for the automotive industry;

– copper pipes made from conticast billets;

– brass band of 0.05 mm thick and aluminum band of 0.18 to 0.2 mm thick;

– aluminum building sections and structures with different protection and decorative finish;

– various products based on rare and rare-earth metals for microelectronics and others high-tech industries.

The technological level of the Russian metals industry as a whole is lower than the world one. Suffice it to say that enterprises are still using open-hearth furnaces for melting steel. Large companies have already started engineering modernization of production units hoping to complete essential work in five or six years. They are ready to use some of their profit for increasing investments and are capable of obtaining major credits. But the State should create more favorable conditions for long-term investments.

By estimates, the production structure of Russia’s steel industry will correspond to world standards by 2010. The share of converter steel will amount to 68 % and electric furnace steel will account for 28 %. In case the open-hearth furnace technology survives, it will be used at non-specialized enterprises in other industries only. The ratio of conticast steel should be no less than 78 % to 80 %.

|

In 2001 Russia produced 59 million tons of steel that constituted 7 % of the world’s production volume (placed 4th in the world). Export shipments of steel rolled products amounted to 26 million tons accounting for 10 % of the world’s volume of trade in this sector (the world’s 1st place).

The share of Russian companies in the world production of base non-ferrous metals (aluminum, nickel, copper, zinc, lead, tin) equals about 8.5 %. Export shipments amount to around 80 % of their total production volume.

| |

| |

|

It is planned to widely use autogenous processes in production of heavy non-ferrous metals. The share of copper produced by these technologies should increase up to 80% to 85%, and nickel’s share is to be raised to 65 % to 70 %. As for the aluminum industry the emphasis will be made on using upgraded electrolyzers with prebaked anodes as well as on the dry-and-half-dry anode technology: the share of metal produced by these methods will reach from 75 % to 80 %.

Introduction of more effective technologies along with decommissioning of inefficient facilities will lead to job cuts. In minister Klebanov’s opinion, which coincides with companies’ estimates, a number of operational personnel in metals industry will be reduced by about 7 % (100,000 workers) by 2005 and in the years till 2010 the figure will equal 25 % (350,000 workers: 200,000 in steel industry and 150,000 in non-ferrous industry). Employers and government structures, which support them, believe that this is an unavoidable price of progress. Thanks to such decisive actions the Russian metals industry will be capable of improving its quality indicators and increase production volumes 20 % to 30 % by 2010.

There is just one question left: what do labor unions think of it? Their position has already been stated. (See the story in the Social Partnership section of Eurasian Metals’ current issue)

|

back

back