|

| Magazine |

|

| About |

|

| SUMMIT |

|

| Contacts |

|

| Home |

|

|

|

|

|

| |

|

|

|

| #1' 2003 |

print version |

|

|

PIPE INDUSTRY: GROWING INTEGRATION |

|

Alexandra Vertlugina, Maria Radina, Elena Shashkina

AVK Securities & Finance

n the threshold of XXI century Russian pipe-making enterprises confronted the need to find new solutions to business problems. It was clear that they had to find large capital investments to further develop production and rationalize the use of available capacities. That created the necessary prerequisites for integration processes. Mergers started at the beginning of 2001. The Pipe Metallurgical Company (TMK) incorporated the Volzhsky Pipe Plant (VTZ) and Seversky Tube Works (SevTZ). The United Metallurgical Company (UMC) affiliated the Chelyabinsk Tube-Rolling Plant (ChTPZ). However, the alliance of UMC and ChTPZ did not last long: in the fall of 2002 the Chelyabinsk Tube-Rolling Plant left the United Metallurgical Company.

Currently, there are two large holdings operating in the pipe industry: vertically integrated UMC and horizontally integrated TMK.

Two of the seven major pipe-making mills, the Pervouralsk Novotrubny Plant (PNTZ) and ChTPZ, remain outside either of the holdings being independent market players.

HOLDINGS’ HISTORY

Integration of steel makers and higher process stage operators is common for the international business. It started in Russia in the late 1990s, when UMC, the former trader of the Vyksa Steel Works (VMZ), bought controlling stakes in VMZ, the Chusovskoi Iron & Steel Works, Chelyabinsk Tube-Rolling Plant, Gubakha Chemical Recovery, etc. becoming a majority shareholder of about 20 enterprises and structures of the metallurgical complex. It also incorporated Metallinvestbank JSB and an insurance company that made it possible to form a financial industrial group. With this structure the holding operated for less than two years. Then, the split-up with ChTPZ took place and another pipe-maker, the Almetyevsk Pipe Plant, was acquired. The important role in the holding’s development belonged to the project Alliance-1420 aimed at setting up its own production of large-diameter pipes for Russia’s trunk gas pipelines. One of the Russian steel industry’s leaders, Severstal, became the participant of the project along with UMC. At present, Alliance-1420 is being suspended because of uncertainties with orders for this kind of products: Gazprom, the country’s gas monopoly, is their only consumer.

The pipe metallurgical company was set up within MDM Group’s structure. In March 2000 MDM Bank acquired a controlling stake in the Volzhsky Pipe Plant. In July it incorporated Kuznetsk ferrosplavy JSC. In February 2001 MDM Group bought shares of the Seversky Tube Works (SevTZ). After that, in April, the formation of TMK was announced.

In February 2002 the Sinarsky Pipe Works (SinTZ) and TMK made a deal providing for SinTZ’ going over to TMK in exchange for 34% of the holding’s shares to be passed to the owner of the mill. The investment, production, financial, marketing and sales policies of all three pipe-making mills, Volzhsky, Synarsky and Seversky, are conducted under a common trade name. In April MDM Group acquired a 53.9% stake in the Taganrog Metallurgical Works (Tagmet) and since October all Tagmet financial and commodity flows have been going through TMK.

At present, three mills are virtually owned by TMK: it has stakes of over 91% in SevTZ and VTZ as well a 94% stake in Tagmet. TMK’s mills account for about 40% of all pipes made in Russia .

REASONS FOR MERGERS

To a certain extent the vertical integration as it is guarantees stable operation. The holding-incorporated enterprises of starting materials are capable of withstanding price pressure by large sellers, especially so in times of limited supply. It should be noted that costs of starting materials for pipe production run up to 70% of the general cost structure even as Russian prices are just 15% to 20% lower than world prices. Thus, by ensuring reduction of costs the integration makes it easier for the holding to enter the world’s pipe market. In Russia the problem with pipe steel quality still exists. Also, there are interruptions of its supplies. In these conditions the cooperation with metallurgists is of strategic importance. Finally, the principal objective of the vertical integration is to increase capitalization of the holding-incorporated companies, accumulate large funds and production capacities and redistribute them effectively. Integrating the Vyksa Steel Works and Chelyabinsk Tube-Rolling Plant also provided a single sales and price policy, which was discarded after the withdrawal of ChTPZ from UMC.

The objectives of the horizontal integration are somewhat different. The major one of them has always been an achievement or enhancement of the monopoly power so as to increase the sales volume and tangibly influence the price competition. As a result of a merger, a more professional management takes over, overhead expenses on management are rationalized. The integration also makes it possible to secure economy of scale connected with an increased production volume and rational redistribution of capacities that reduces costs and boosts production efficiency. Like in the case with the vertical merger, it becomes possible to centralize sales, make large-scale investments, raise capitalization and increase the share of world market.

The peculiarities of Russia’s metallurgical industry are that there are relatively few large steel makers and large pipe mills. That is why association of pipe makers contributes to the emergence of oligopsony characterized by a significant influence of buyers’ demand on the market of starting materials. The integration of pipe makers in TMK provides them with sufficiently solid position in dealings even with Magnitogorsk Iron & Steel Works (MMK), the largest enterprise of Russia’s steel industry, permitting to lay down terms of reducing prices for steel and of improving its quality.

RESULTS OF INTEGRATING WITH SUPPLIERS

The main suppliers of tube strip to pipe-making mills of UMC are Severstal (75% of supplies after the start-up of the Alliance-1420 project) and MMK. Shortages of starting materials, which grew bigger in the second half of 2002, had a negative impact on the company’s program of pipe production. At the same time metallurgical enterprises incorporated in UMC serve as a stabilizer. For example, the Chusovskoi Iron & Steel Works accounts for 75% of cast iron supplies to manufacture railroad wheels. The return on sales of wheels amounts to about 30% of UMC’ total receipts and the company’s share of this market segment equals 63%. It is strategically important to UMC as the largest manufacturer of railroad wheels to control the whole chain: from casting iron to putting out finished products.

If the United Metallurgical Company decided to significantly develop pipe production, then, it would benefit the most from strengthening ties with Severstal. The Alliance-1420 project could be regarded as the first step toward vertical integration of UMC and Severstal. However, these plans were disrupted because of the Alliance’ failure. The existing UMC structure does not help reduce expenses on starting materials for pipe production and does not permit to control supplies of strip and its quality sufficiently enough.

INTEGRATION IMPACT ON PIPE PRODUCTION

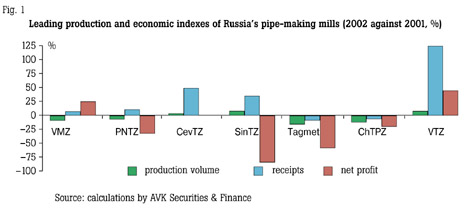

In 2002 the pipe production experienced a downturn while metallurgists raised prices for starting materials two times. When the production was falling down, PNTZ increased the volume of revenue through prices but, anyway, its net profit went down significantly. TMK’s mills moved to focus on ensuring stabilization and increasing production volume. Taking into account products of SinTZ and Tagmet as if these mills remained incorporated in TMK in 2001 as well, the holding’s production volume in 2002 climbed up 2%, its receipts increased 39% and the estimated net profit went down 46%. The similar calculation for UMC shows the reduction of the production volume by 11.6% and the increase of the revenue and net profit amounting by 0.1% and 2.9% respectively. With production volumes going down significantly the financial indexes slightly rose due to the impact of the vertical integration.

The decrease of TMK’s profit took place because of profit reduction at SinTZ, which was caused by the growth of non-production expenses. Among mills VTZ was the most successful as it increased the output by 5%, the revenue 2.2 times and profit 1.4 times. So, it became clear that TMK’s management attended mainly to problems of VTZ and redistributed cash flows in its favor.

The horizontal cooperation may have a positive impact on production. Redistribution of orders among the mills contributes to increased competitiveness of their products. VTZ’ modern steel-making facilities make up for shortcomings of technologies at SevTZ, which in turn provides free capacities for cutting pipe threads. As a result, the output of pipe casings at TMK was raised: up to 90% of VTZ’ pipe casings are exported while SevTZ’ products are in demand by Russian oil companies.

As a whole, the horizontal integration contributes to improving production indexes more than the vertical one. Through strengthening its monopoly influence a horizontally integrated company can control, to a certain extent, the price level that makes it possible to increase revenue. At the same time, TMK’s production profitability went down more than the industry’s average proving its lack of attention to the problem of cost reduction.

INVESTMENT POLICY WITHIN HOLDINGS

Let us take 2001 and 2002 to evaluate investments: In a few months after joining UMC the Chelyabinsk Tube-Rolling Plant (ChTPZ) obtains Sberbank’s credit of about $14.4 million for development. The holding’s management plans to invest $32 million in reconstructing shop1 at ChTPZ for the purpose of making oil pipes. At the same time, UMC speeds up modernization of other enterprises and development of the complete pipe production technological chain. Large investments are made in the project to create "a single steel-making complex" based on the Chusovskoi Iron & Steel Works. Thus, the company intends to get rid of the outdated open-hearth way of making steel and to form a total production cycle. The integration permitted pipe mills to participate in the Alliance-1420 project. Although it was suspended soon, the project gave a push to the process of modernizing capacities. As a whole, volumes of investment funds used at UMC’ mills keep growing.

In the last two years TMK’s shareholders and management were involved mainly in buying stock of pipe-making mills. Nevertheless, it did not prevent the holding from forming an investment policy to modernize already existing capacities. In 2002 VTZ and SevTZ issued bonds, which helped reequip the large-diameter pipe complex at VTZ and made it possible to acquire a furnace-ladle out-of-furnace steel processing unit at SevTZ. SinTZ spent $30 million on constructing and setting up a new line to cut thread on oil and gas pipes. In 2002 only Tagmet weakened by scandals with its stock did not upgrade its capacities.

Practically all TMK-incorporated mills actively use their own and borrowed funds to finance investment programs, borrowings being on increase. However, with the present extent of financial transparency the growth potential of borrowed funds is greatly limited. The amount of current assets at the TMK-incorporated mills is decreasing and that is why the attraction of short-term borrowed funds is required for forming working capital. Promissory notes’ share in the SevTZ payment structure is on the increase. In 2002 the amount of receivables at SinTZ doubled and that entailed the proportionate growth of payables’ amount. On the face of it, the efficiency of mill-by-mill financial activity decreased after the integration but to draw a conclusion with respect to the holding as a whole is not possible due to the absence of accounts. Thus, deterioration of liquidity indexes by the individual mills will hinder attracting long money against investment programs.

The second limiting factor is the low value of assets, which serve as credit security since the amount of credit is in direct proportion to the value of assets being in pledge. The holding should take care of increasing the value of assets at its mills so as to raise the potential credit amount and strengthen guarantees of retaining its control over them.

CAPITALIZATION CHANGE AS A RESULT OF MERGERS

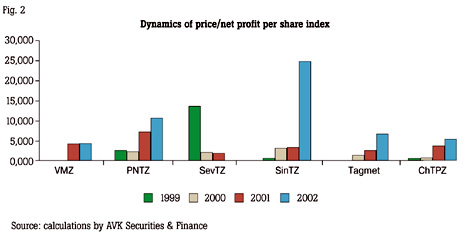

The change in market value of a newly formed company is assumed to be one of integration results. It is impossible to assess results of integration by changes in capitalization of Russian companies. In most cases these results, which come to increased investments and improved stability of companies in face of changes in external conditions, practically have no impact whatsoever on market value.

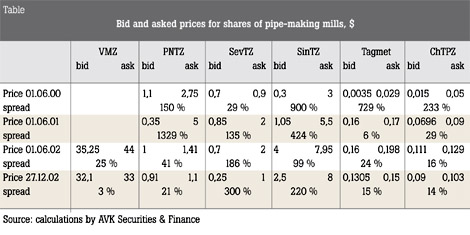

As far as capitalization of mills is concerned, one has to keep in mind that this term is applicable to the full extent only with respect to the mills incorporated in UMC. Shares of these enterprises are trading quite actively and that makes it possible to analyze changes in their capitalization. However, since TMK consolidated over 90% of its mills’ shares, any dealings with them, in fact, do not make sense. That is why existing quotations do not reflect the actual value of the mills.

In our case bid prices are used for the analysis because they are the lowest possible price, which an investor can sell his papers for. Since dealings with shares of pipe-making mills are rare and their value is not connected to the actual market assessment of mills’ activity, there is a large spread between asked and bid prices. Thus, the value calculated by asked prices may exceed 1.5 to 2 times the value calculated by bid prices. From this point of view, quotations of SevTZ and SinTZ may be considered indicative because a significant difference between the bid price and the asked price has been evident throughout the whole analysis.

So as to calculate the minimal market value of TMK we used the total of value estimates for TMK’s mills calculated on the basis of available quotations. The value of VTZ was calculated on the basis of assumptions since the mill’s shares do not trade in the market. Thus, the minimal market value of TMK amounts to between $125M and $157M. As a result of the recent $300M deal to sell a 34% stake in TMK made by MDM Group with Mr. Pumpyansky, it is reasonable to conclude that the company’s total value was estimated at $880 million or 6 to 7 times as much as its estimated value. It proves that shares of TMK’s mills are not adequately valued.

|

|

The investment company AVK Securities & Finance was set up in 1993. Provides services to all customer groups, including companies, private citizens, institutional investors and financial institutions. Principal specialty: financial and management consulting for corporate customers, broker services on security market, arrangement of bond loans, depositary services, management of customer assets through co-op share funds.

By results for 2001 AVK is included in the A+ highest reliability group by ratings and rankings of the National Association of Stock Exchange Dealers. Dun & Bradstreet Nord, the international consulting company, assigned the company the A2 rating that proves AVK’s increased financial potential and minimal risk of cooperation.

|

| |

|

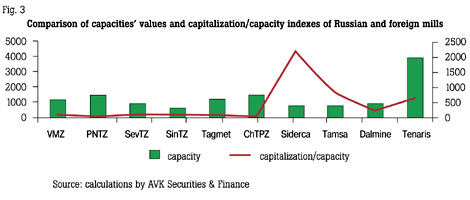

The comparison of capacities of Russian and foreign pipe-making mills as well as the capitalization/capacity multiplier values shows that Russian assets are undervalued. Although to make a comparison the value of Russian mills calculated by asked prices was used, their average value is 13 times as low as the similar value of foreign mills with smaller capacities. Fig.3 shows indexes of Russian mills in comparison with indexes of the holding Tenaris that incorporates the mills Siderca, Tamsa and Dalmine.

The capitalization/production volume index shows a market value estimate of production activity. So as to compare multiplier values, VTZ’ values were equated with the industry’s average. The minimal market value estimate of TMK was calculated on the basis of assumptions.

The production volume of TMK equals two thirds of the one of the company Tenaris. However, the capitalization of the foreign holding is approximately 18 times as high. Assuming that the multiplier value for TMK is equal to the similar one for the foreign holding, the value of TMK might be 12 times as high as the originally calculated one. Thus, it is reasonable to conclude that TMK can significantly raise its value through transferring to a single share as Tenaris did.

So as to raise TMK’s estimated value like in the case with Tenaris the following steps should be taken: to increase the holding’s financial transparency, to transfer to the holding’s uniform accounting, to consolidate assets, to transfer to a single share, to improve corporate governance.

We concluded that the financial state of the TMK-incorporated mills has worsened lately. Big capital investments are needed to modernize practically all mills. But in order to successfully attract investments it is necessary to raise the mills’ value. Thus, the recent statement by Dmitry Pumpyansky, the general director of TMK, about plans to transfer to a single share and enter stock market is quite timely and well-founded.

|

|

|

|

|

|

current issue

previous issue

russian issue

|

|

back

back