|

| Magazine |

|

| About |

|

| SUMMIT |

|

| Contacts |

|

| Home |

|

|

|

|

|

| |

|

|

|

| #2' 2003 |

print version |

|

|

COOPERATION IS STILL POSSIBLE |

|

Andrei Alexandrov

General director, TITAN Interstate Association

he world market of titanium is not as great as markets of other structural materials. But by the diversity of production and consumption structures it is of an extreme interest. Right up to the beginning of the 1990s the titanium industry was mainly oriented on the military industrial complex and that determined rates of its development. The rapid growth of demand for titanium was caused by implementing projects in aviation, shipbuilding, missile engineering. With the end of the Cold War the titanium industry experiences its deepest recession. It was given a new impulse in 1994 by the long-term program of developing civil aircraft construction at the companies Boeing and Airbus based on a wider use of titanium components in airliners.

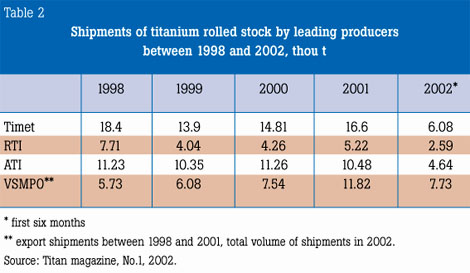

In those years the U.S. titanium industry was lacking foundry and processing capacities. Russian producers played the role of ‘fire fighters’, to the contrary, they experienced serious difficulties due to the sharp decline of demand for titanium in CIS countries. They managed to use their chance and consolidate their position in the world market. The Verkhne-Saldinskoye Metallurgical Production Association (VSMPO) was particularly successful. Having a high technological level of production and effectively operating quality system, this enterprise certified its products according to requirements of international manufacturers of aircraft and aircraft engines. As results of 2002 prove, VSMPO is capable of regaining the world leadership in volumes of titanium production.

Problems on the air transport market, which are connected with events of September 11, 2001 in the U.S., have had their impact on volumes of the titanium consumption in aviation. Suppliers in CIS countries have felt it as well. But even with all the pessimistic predictions the general prospects do not look catastrophic to them. The demand within CIS is on the rise again: in the last three years volumes of the titanium consumption in the countries of the Commonwealth increased 1.7 times.

The rallying of the domestic market brings again to the forefront important questions concerning the titanium industry itself, including the technical state of enterprises, the level of their competitiveness as compared with Western companies. To a larger extent the major problem is related to the availability of scientific assets and training of scientific personnel. Because of limited funding of scientific research and educational institutions the continuity of generations in this field was disrupted. In order to urgently make up for deficiencies, the TITAN Interstate Association intends to create several educational programs. The case in point is to train not only metallurgists but also engineers, designers and architects, who know methods of working with titanium.

The problem of developing the ore base of the titanium industry is also still important. Russia possesses considerable discovered reserves of this metal but so far ilmenite concentrates, the main raw materials, are yet to be imported from Ukraine. Besides, the need for raw materials is also growing in other branches of the titanium industry and, in particular, for producing pigmentary titanium dioxide as well as for electrode manufacturing.

A major role in the formation of the titanium industry belonged to cooperation. And today the previous specialization is mainly preserved within the CIS. Ukraine leads in producing concentrates, Russia, Ukraine and Kazakhstan make spongy titanium, Russia and Ukraine manufacture ingots and semi-finished products, alloying compositions are produced by Russia, Ukraine and Tajikistan. The development of the industry much depends on simplifying customs rules and currency settlements between CIS countries. The modern titanium market features a high competition and trade restrictions deprive suppliers of flexibility when advancing their products to the most attractive market segments.

There are, of course, prerequisites for developing the domestic consumption of titanium. The example of Bereznikovsky integrated titanium-magnesium mill JSC (AVISMA) is very indicative in this respect. AVISMA has practically given up export shipments of sponge titanium, although the enterprise’s volumes of its production are annually growing. At the same time import shipments of sponge titanium by the Zaporozhsky integrated titanium-magnesium mill (Ukraine) to Russia are increasing.

Enterprises of Russia’s titanium industry managed to maintain their sufficiently high technical level. Above all, this is true with the holding VSMPO-AVISMA, the industry’s leader, which by its technical potential does not yield to any Western competitor.

Enterprises of the titanium industry are now getting more orders from aircraft plants, chemical engineering companies. VSMPO, Prometei (St. Petersburg) and Setav-Nikopol (Ukraine) are restoring cooperative relations in areas of producing cold-rolled pipes for the aircraft and shipbuilding industries. There are options under consideration to include in this chain several Russian pipe-making plants.

The use of titanium in the field of energy is especially promising. It includes such important facilities as heat-exchange equipment for nuclear and thermoelectric power plants and main condensers of nuclear power plants. Manufacturing these condensers from titanium became possible after VSMPO developed production of welded thin-walled titanium pipes up to 25 m long with the thickness of walls amounting to between 0.6 and 0.8 mm. About 500 such pipes are needed to make one condenser.

The market of consumer goods may become one of new directions for using titanium in the CIS. In many countries consumers have grown accustomed to having light, elegant and durable items made of this material that not long ago was considered purely technical. It is already hard to imagine modern wristwatches or eyeglasses without titanium-made bodies and frames. Such goods are also available in Russian stores but they are all foreign-made only. Meanwhile, this segment of the titanium market accounts now for about 10% and it is quickly expanding significantly surpassing other areas of using this metal. Prospects are also good for the use of titanium in the automotive industry, architecture. As far as the Russian titanium market is concerned, it is good news. Let’s hope it continues.

|

|

|

|

|

|

current issue

previous issue

russian issue

|

|

back

back