|

| Magazine |

|

| About |

|

| SUMMIT |

|

| Contacts |

|

| Home |

|

|

|

|

|

| |

|

|

|

| #5' 2003 |

print version |

|

|

ELECTRODE MARKET: NONSTANDARD SITUATION |

|

Yevgeny Khokhlov

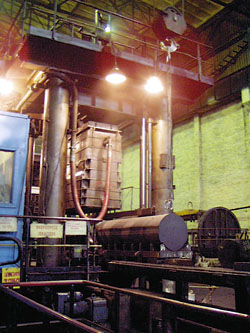

The vibropress supplied by Germany’s KHD makes the Novosibirsk Electrode Plant the only one in Russia that is capable of producing large-sized coal electrodes and graphitized electrodes with 600 mm in diameter

Photo by Sergei Slobodchikov, NovEZ |

|

As a result of the investment bidding contest, the Novosibirsk Electrode Plant (NovEZ) was passed into the ownership of the Energoprom Group’s stockholders. Besides NovEZ there are two more enterprises of the electrode industry in Russia and they are also owned by Energoprom. So, for the first time since the start of the Russian privatization the whole industry of the country’s metallurgical complex turns out to be in one hands that has long-term consequences for both producers and the market as a whole.

ttempts to divide the market of electrodes and carbon materials, thus removing "the ineffective competition", were already made at the end of 2001. That time Russian electrode plants together with the raw material extracting enterprise JSC Sibirsky Antratsit and the sub-industry’s scientific organizations established the association Uglegrafit. They proclaimed their coordination of market activity one of the major tasks. However, the creation of a full-fledged concern was hampered by the fact that NovEZ, the largest maker of electrode products, was bankrupt and its leading creditors, the Energoprom Group and the aluminum company SUAL Holding, were engaged in the intense struggle for the plant’s property complex.

Precisely these companies, which controlled 90 % of NovEZ’ debts, acted as the main participants of the investment bidding contest, which took place on March 29, 2003. Energoprom won the bidding by offering the best business terms and a higher price. So, it received an opportunity to freely implement plans related to the association Uglegrafit and impose its conditions on the market.

RETURN TO THE PAST IS NOT ALWAYS A STEP BACK

"When the whole sub-industry is under one’s control, it is not difficult to conduct a strict price policy", agrees Vilory Kim, the deputy general director of Energoprom JSC. "But this is not the aim of integration as we see it".

Vilory Kim, who is responsible for the company’s production policy and technical re-equipment of enterprises, refers to the world experience with "today’s emphasis on quality of electrode products". As Kim says, "we are dealing with this problem as well. The complexity here is that the market quite limited and upgrading electrodes’ operational characteristics results in reduction of their consumption volumes. So, it turns out the better the quality of your product is, the smaller the demand for it is. Not a single enterprise can survive under such conditions".

In the words of Vilory Kim, Energoprom is raising the competitiveness of its plants through their strict specialization in making these or those types of products. In particular, NovEZ is producing cathode blocks and sheathings for aluminum plants, carbon electrodes for the silicon industry and large-diameter graphitized electrodes. The Chelyabinsk Electrode Plant (ChEZ) is specialized in making structural materials, blast-furnace blocks, carbon and carbon materials of high process stages for the nuclear power industry, among other customers. The Novocherkassk Electrode Plant (NEZ) is focusing on producing graphitized electrodes for the non-ferrous metallurgy.

Basically, the previous specialization that existed in the years of the planned economy is now being restored. The plants’ directors think that this "return to the past" is quite justified. Despite the stormy decade of reforms, which was accompanied by bankruptcies, change of owners, mergers and acquisitions, all enterprise that were making metals in the Soviet times still continue doing their usual business and not a single one of them has been liquidated. As a result, the traditional market structured by sectors and geography of supplies are being kept unchanged.

The specialization of NovEZ is determined by the objective factors. There is a large source of raw materials, the Gorlovskoye deposit of anthracites, the field that is unique by its reserves and their quality field is located nearby. From the territorial point of view NovEZ is close to enterprises of Siberia’s steel industry that include Russia’s most high-capacity aluminum plants. Finally, the engineering equipment of NovEZ allows it to make those types of products that other electrode plants are unable to develop.

|

|

|

Victor Pirogov

The general director of the Novosibirsk Electrode Plant. Born in 1951 on the Sakhalin Island. Has a versatile education and a rich experience in management. Graduated from the physics and mathematics school with the Novosibirsk State University and, later, the Novosibirsk Electrical Engineering Institute specializing in automated management systems. Besides, received the second higher education and a diploma of economist. Over 20 years worked in the system of Ministry of Middle-Sized Engineering (the nuclear power industry), at integrated mills with personnel numbering between 40,000 and 50,000 people, where he was raised from being an engineer to the post of the first deputy general director. Later, became the general director of the ferroalloy mill in Kazakhstan, the first deputy director of the Bogoslovsky aluminum plant in the Urals. Has been heading the Novosibirsk Electrode Plant for the last three years.

Loves sports and active rest. Indulges in the "freedom of movement": driving a jeep off the road, a motor boat on Siberian rivers, a snowmobile in wintertime, hunting. In his younger years was seriously mastering sport swimming and skiing having a candidate-to-a-sports-master degree in each of them. Right now prefers mountain skiing.

|

|

| |

|

MONOPOLY THAT IS NO OBSTACLE TO COMPETITION

Victor Pirogov, the general director of the Novosibirsk Electrode Plant, points out that the introduction of the outside management followed by the bankruptcy procedure seriously hurt the reputation of this basically capable enterprise. "Consumers and the foreign ones in particular began doubting our ability to fulfill contract obligations", says Pirogov. During the bankruptcy proceedings sales volumes went down 26 %. That is why the general director regards the settlement of property disputes and the emergence of the real owner as the most important events for the plant. Calming down of the situation around NovEZ immediately influenced its production indexes. "In the first six months the production volume increased 1.6 times", reports Victor Pirogov. And for 2003 as a whole we are planning to make products worth $60 million as compared with $43 million in 2002".

Managers from NovEZ also point to the positive factor of the plant’s specialization. According to Andrei Andreev, the head of the sales department, the plant’s marketing policy is coordinated with the tasks of the association Uglegrafit, within which the re-distribution of loading production capacities took place and competitive advantages of each enterprise were put to a more effective use. "We improved the technological processes and accelerated developing new types of products", states Andreev. In his opinion, precisely this let the plant enter foreign markets with its products and return to positions in the traditional sectors of the Russian market, where foreign producers had already managed to settle down. Andreev cites convincing examples of NovEZ’ successful marketing: "we got back our niches from the Japanese, who are the leading producers of graphitized electrodes, from the American company UCAR and Germany’s SGL Carbon".

Despite some apprehension, the emergence of the company Energoprom as a monopolistic group and dividing of influence spheres between participants of the association Uglegrafit did not result in the disappearance of competition. Only ineffective methods of rivalry were discarded because they just slowed down the development process. Russian electrode plants are still operating in free market conditions and the demand of consumers for their products remains the solid acknowledgement of their success.

General director of NovEZ Victor Pirogov cites a convincing practical example:

"It is well known that today cathode blocks at the electrolysis production facilities of Russia’s largest aluminum plants, Bratsk and Krasnoyarsk, operate no less than 55 months as compared with 38 to 42 months that was the case quite recently. By keeping to raise the durability of our products we are, thus, reducing the demand for them. It does not seem to make sense, does it? But in reality it is not all that simple. There is a market, more than one third of which belongs to imported products. In order to hold one’s ground on it, there is a need to offer products of better quality".

NovEZ is satisfying up to 70 % of the needs of company Russian Aluminum in cathode blocks and it, of course, takes into account Russian Aluminum’s intention to increase the overhaul life of electrolyzers up to 60 months. Successfully meeting requirements of this consumer made it possible to take a next step. The plant established contacts with the company Alcoa, the leader of the world aluminum market, and sent it a trial batch of its products for laboratory testing. In the words of Victor Pirogov, Americans were impressed with the excellent quality of the Siberian anthracite and later they got convinced of Russians’ ability to make high-quality and not too expansive products of good raw materials.

"So as to better understand the needs of our partners and prove our readiness for a long-term cooperation, we are conducting a joint technical audit", says Pirogov. "Companies’ officials visit our plant, check out all process stages, express their opinions. In six months or a year a new inspection takes place. Such an openness not only helps improve the technological discipline but also raise the level of mutual trust".

SPECIALIZATION DOES NOT AFFECT RANGE OF PRODUCTS

The specialization has not limited the range of products at the electrode plants. On the contrary, it gave them an impetus to look for new opportunities starting with the use of new kinds of raw materials. The general director of NovEZ is pleased to report that his enterprise is now "purchasing acicular coke, which is being produced by only three countries in the world: Great Britain, the U.S. and Japan". Electrode made of acicular coke has been well received by the market. In the words of Pirogov, in a year NovEZ doubled their production from 500 to 1,000 tons a month.

Victor Pirogov also draws attention to other types of new products developed recently by the plant. Among them are carbon electrodes with 960 mm in diameter. Germany’s RW Silicium has become their buyers. Just in one year this German company, which is dynamically expanding its production potential, increased a volume of orders three times as much.

Usually, carbon electrodes are made as a unit of union cylindrical nipples. It is a quite vulnerable component that very often becomes the cause of electrode rupture during the metal melting process. And, if to take into account the loss of time, electric power and production volumes that every such rupture causes, then, according to specialists from NovEZ, it amounts to approximately $200,000. This prompted them to develop a monoelectrode of the original design. The new article attracted the attention of officials from Australia’s Simcoa, which specializes in producing especially high purity silicon for computer chips. The company successfully tested these monoelectrodes and ordered a trial batch of them. As market experts from NovEZ believe, there are all the reasons to expect a large order from Simcoa in 2004. They also name as monoelectrodes’ permanent users Norway’s Elkem, which highly regards products of NovEZ being convinced that they are better than, for example, the Italian ones.

In the first six months the export shipments of carbon electrodes increased 2.5 times and exceeded 3,000 tons for the total amount of $2.3 million. The chart given below shows the dynamics of the carbon monoelectrode export. Export shipments of graphitized products are also on the rise: in the first half of this year their sales volumes in foreign markets amounted to $1.3 million. Experts from NovEZ are continuing their scientific studies in this area. Production of graphitized monoelectrodes with 400 mm in diameter has become one of the results of their work.

|

|

The Energoprom Group incorporates enterprises of the electrode industry and a number of the economy’s other sectors being the largest supplier of materials for both non-ferrous and ferrous metallurgies. The Group controls: the unique deposit of anthracite in the Novosibirsk region and its mining enterprise, three plants for making carbonic and graphite products, enterprises for processing of shale oil and secondary reprocessing of oil products as well as producing industrial chemicals. As far as these enterprises are concerned, Energoprom is acting as their management company.

From its very beginning the Energoprom Group has been closely connected with the aluminum business. Stockholders of the Bratsk aluminum plant became its founders. By the mid-1990s the Group started to control 70 % of raw material supplies to the aluminum industry. Except alumina, Energoprom provides all kinds of raw materials needed for the electrolysis production: carbonic products, coke, pitch, fluoric salts.

|

| |

|

ACCELERATED MODERNIZATION WITH LACK OF INVESTMENTS

The investment program for the Novosibirsk Electrode Plant, which was presented by Energoprom at the bidding contest, did not impress much. In the nearest three years a rather modest amount of $13 million will be invested in developing production, including reconstruction works. But, as financial director of NovEZ Dmitry Sheptyakov believes, this program has one doubtless advantage: it is pragmatic and realizable. "Capital costs are directly connected with the growth of production and sales volumes, with the rise of products’ quality", Sheptyakov notes.

The plant is consistently modernizing its kilns and significantly increasing their productivity. The next step will mark more radical engineering improvements connected with the switchover to the principally new roasting technology. As Victor Pirogov promises, the first such furnace will be put into operation no later than in mid-2004. Later, this technology will be used as a basis for reconstructing other kilns as well.

At the same time Pirogov feels sorry to say that so far limited investment resources do not allow to start replacing equipment for machining electrodes, although "a number of orders is constantly growing and there are new consumers in foreign markets, where requirements for accuracy and treatment neatness are much higher". Nevertheless, he does not rule out that the expansion of market opportunities will influence investors’ behavior and the program of investments in developing NovEZ "should be enlarged".

Deputy general director of Energoprom JSC Vilory Kim also believes that volumes and the very structure of investments will change. In his words, so far the main source of investments is the Energoprom Group. "But since the implementation of both short- and medium-term programs now requires to significantly increase the investment volume, we are trying to attract additional financial resources", Kim says. "In our opinion, they will be mainly credits by Russian banks. Our talks are moving forward successfully and I think that soon our investment plans will be finalized".

At present, the largest project, for which Energoprom intends to obtain credits, is the construction of a concentrating mill at JSC Sibirsky Antratsit. In Vilory Kim’s words, the project is estimated at $20 million and it should be implemented in 16 to 18 months from the beginning of construction works. He also says that these construction works have already started, orders for necessary equipment has been placed in Germany, Great Britain and the U.S. Companies have been chosen on the basis of the customer’s high requirements. "The use of the most advanced concentrating technologies is provided for. A new mill will double coal and will permit to rearrange the organization of the whole working process", informs Kim.

Commenting on development prospects of Energoprom Vilory Kim stresses that the Group is in the process of restructuring. "Serious efforts should be made so as to raise the company’s capitalization. To this end it is necessary to bring our business in accordance with the international standards. This is the most urgent task", Kim believes. In his words, stockholders of JSC Energoprom "believe that the integration inside the Group and, above all, among plants, of the electrode industry will expand and they do not rule out a possibility of establishing a holding".

|

|

|

|

|

|

current issue

previous issue

russian issue

|

|

back

back